美联储大幅降息,并预测未来还会进一步降息

【中美创新时报2024 年 9 月 19 日编译讯】(记者温友平编译)美联储周三将利率下调了半个百分点,这是一个不同寻常的大幅举措,也清楚地表明央行行长认为他们正在赢得抗击通胀的战争,并将注意力转向保护就业市场。《纽约时报》记者珍娜·史密亚莱克(Jeanna Smialek)对此作了下述报道。

美联储主席杰罗姆·鲍威尔在新闻发布会上表示:“我们过去一年的耐心做法已经获得了回报。”但现在“通胀的上行风险已经减弱,失业的下行风险已经增加。”

美联储的决定将利率从二十多年来的高点降至 4.9% 左右。

这一转变是对数月通胀消退的回应,旨在防止经济放缓幅度过大,导致就业市场开始更加痛苦地疲软。官员们一直在密切关注近期失业率的上升,美联储通过大幅降息,实际上是在为应对更严重的就业放缓采取保险措施。

为强化这一谨慎信息,此次决定性降息与经济预测同时出现,经济预测显示降息速度比官员们几个月前预想的要快。官员们现在预计在年底前再降息半个百分点。

“我们将逐次会议讨论这个问题,”鲍威尔说。“我们有一个良好、强劲的开端,坦率地说,这是我们信心的标志,相信通胀正在下降。”

虽然鲍威尔表示,美联储尚未准备好宣布“完成”抑制通胀的任务,但他补充说,官员们对他们看到的进展感到“鼓舞”。

周三的降息标志着初步胜利。到目前为止,美联储官员已经设法显著减缓通胀,而没有造成重大经济问题。失业率有所上升,但并没有大幅上升。尽管招聘有所放缓,但招聘仍在继续。消费者支出依然强劲。整体增长仍然强劲。

这种韧性让美联储官员充满希望,他们或许能够实现历史上罕见的“软着陆”,即在不引发衰退的情况下让经济走上健康可持续的轨道。

鲍威尔表示:“我们正试图实现一种恢复物价稳定的局面,而不会出现有时出现的那种痛苦的失业率上升。”此前,他表示,他对美联储能够做到这一点“更有信心”。

但央行的任务尚未完成。

高利率使借贷买房或扩大业务的成本更高,从而拖累经济,进而影响需求和物价上涨。但高利率也抑制了招聘。鉴于此,美联储一直在努力实现谨慎的平衡。官员们的目标是将经济增长放缓到足以确保物价上涨恢复正常,但又不能降温太多,以免失业率飙升,经济陷入衰退。

政策制定者仍必须决定在未来几个月和几年内降息多少、降息速度如何,才能实现这一目标。这就是为什么周三的经济预测值得关注:它们提供了美联储官员下一步预期行动的快照。

美联储官员预测,他们将在今年年底前将利率降至 4.4%——远低于他们在 6 月份上次发布经济估计时预期的 5.1%。到 2025 年底,他们预计将把借贷成本再降低一个百分点,至 3.4%。

对于白宫来说,美联储周三的声明令人鼓舞。在经历了多年的物价快速上涨之后,此举标志着一个强有力的宣言,表明通胀回归正常已在眼前。

“虽然这一声明对承受高价冲击的美国人来说是个好消息,但我的重点是继续努力降低物价,”民主党候选人、副总统卡马拉·哈里斯在一份声明中表示。

相比之下,美联储在 2024 年总统大选前几周决定降息,这引起了共和党候选人、前总统唐纳德·特朗普的愤怒。

特朗普周三在纽约市一家加密货币相关酒吧对记者表示:“如果降息这么多,假设他们不是在玩弄政治,经济就会非常糟糕,或者他们在玩弄政治。”

美联储官员的决策不受政治因素影响,政策制定者一直坚称,他们在决策时不会考虑政治因素。但即使他们几乎没有能力控制美联储的行动,现任官员通常也希望在他们任职期间看到低利率。

除了向经济发出积极信号(至少在这种情况下),美联储降息也有利于消费者。由于预期央行降息,抵押贷款利率已经下降,这让普通家庭买房变得容易一些。(它们不太可能回到 2020 年的最低水平,因为美联储预计不会将利率降至接近零的水平。)

美联储将不得不在未来几个月谨慎行事。

一些经济学家担心,美联储已经面临落后的风险,因为失业率已升至 4.2%,按历史标准来看,这一水平较低,但比 2023 年初的 3.4% 有显著上升。

其他人则担心,通过迅速降息,美联储可能会加速经济增长,导致通胀陷入令人不安的高水平。美联储理事米歇尔·鲍曼 (Michelle W. Bowman) 周三投票反对降息。她更希望降息幅度较小。

鲍威尔在新闻发布会上明确表示,如果经济表现弱于或强于预期,美联储愿意加快或放慢降息步伐。他表示,政策制定者希望稳住经济,而且越来越有希望实现这一目标。

鲍威尔说:“美国经济状况良好,我们今天的决定旨在保持经济状况。”

然而,尽管美联储降息标志着一个重要时刻,也是前进的一步,但经济学家和分析师表示,现在宣布美联储已经实现软着陆还为时过早。

“现在这么说,就像是在滑雪跳台的中间说你已经着陆了一样,”道明证券美国利率策略主管 Gennadiy Goldberg 表示。“我们仍然悬而未决。”

本文最初发表于《纽约时报》。

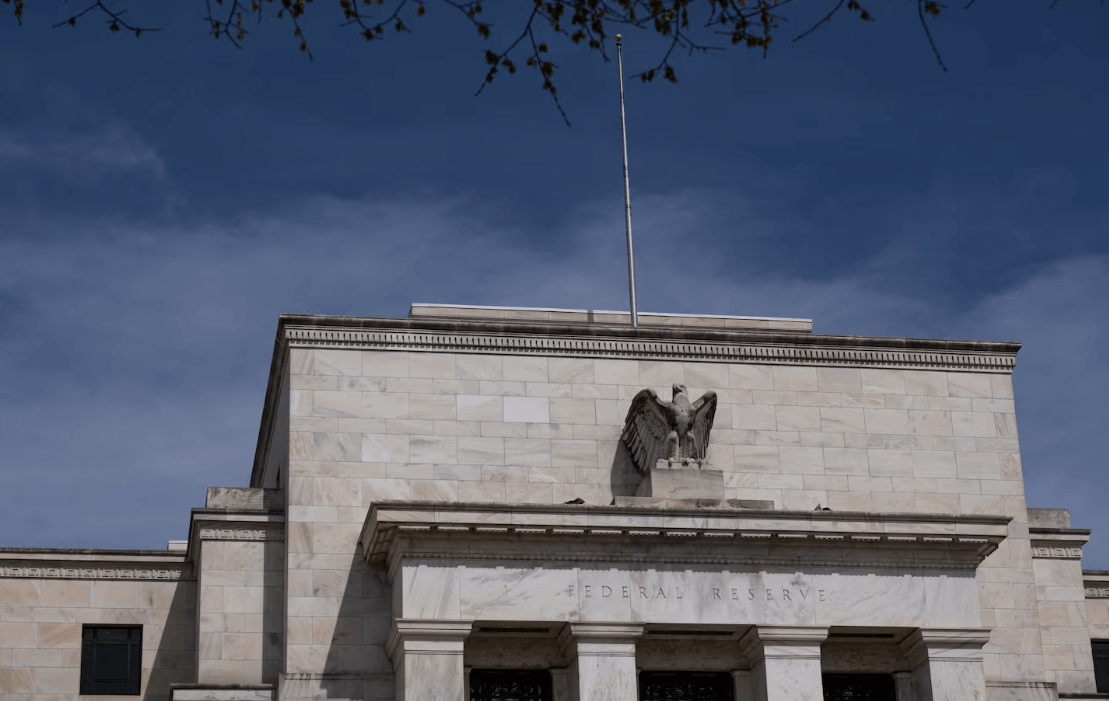

题图:华盛顿的美联储大楼。HAIYUN JIANG/NYT

附原英文报道:

The Federal Reserve makes a large rate cut and forecasts more to come

By Jeanna Smialek New York Times,Updated September 19, 2024

The Federal Reserve building in Washington.HAIYUN JIANG/NYT

WASHINGTON — The Federal Reserve cut interest rates Wednesday by half a percentage point, an unusually large move and a clear signal that central bankers think they are winning their war against inflation and are turning their attention to protecting the job market.

“Our patient approach over the past year has paid dividends,” Jerome Powell, the Fed chair, said during his news conference. But now “the upside risks to inflation have diminished, and the downside risks to unemployment have increased.”

The Fed’s decision lowers rates to about 4.9%, down from a more-than-two-decade high.

The pivot comes in response to months of fading inflation, and it is meant to prevent the economy from slowing so much that the job market begins to weaken more painfully. Officials have been keeping a careful eye on a recent uptick in the unemployment rate, and by starting off with a big cut, the Fed is in effect taking out insurance against a bigger employment slowdown.

Reinforcing that cautious message, the decisive reduction came alongside economic projections that suggested a swifter pace of rate cuts than officials had envisioned just a few months ago. Officials now expect to make another half-point reduction before the end of the year.

“We’re going to take it meeting by meeting,” Powell said. “We made a good, strong start to this, and that is frankly a sign of our confidence, confidence that inflation is coming down.”

While Powell said that the Fed was not yet ready to declare “mission accomplished” on taming inflation, he added that officials were “encouraged” by the progress that they had seen.

Wednesday’s rate cut marks a preliminary victory. So far, Fed officials have managed to slow inflation notably without causing major economic problems. The unemployment rate has crept up, but it hasn’t jumped painfully. Hiring persists, though it has slowed. Consumer spending remains strong. Overall growth is still robust.

The resilience has made Fed officials hopeful that they might be able to pull off a historically rare “soft landing,” in which they manage to put the economy on a healthy and sustainable track without causing a recession.

“We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes,” Powell said, after saying that he had “greater confidence” that the Fed could do it.

But the central bank’s task is not yet complete.

High interest rates slow the economy by making it more expensive to borrow to buy a house or expand a business, which weighs on demand and price increases. But they also hold back hiring. Given that, the Fed has been trying to strike a careful balance. Officials have aimed to slow growth enough to ensure that price increases return to normal without cooling it so much that the unemployment rate soars and the economy tips into a recession.

Policymakers must still decide how much and how quickly to lower interest rates in the coming months and years to reach that goal. That’s why Wednesday’s economic projections are notable: They provide a snapshot of what Fed officials expect to do next.

Fed officials predicted that they would cut interest rates to 4.4% by the end of the year — much lower than the 5.1% they had been expecting in June, when they last released economic estimates. And by the end of 2025, they expect to lower borrowing costs another full percentage point, to 3.4%.

For the White House, the Fed’s announcement Wednesday was encouraging. After years of rapid prices increases, the move marked a powerful declaration that a return to normal inflation was in sight.

“While this announcement is welcome news for Americans who have borne the brunt of high prices, my focus is on the work ahead to keep bringing prices down,” Vice President Kamala Harris, the Democratic nominee, said in a statement.

By contrast, the Fed’s decision to cut rates just weeks before the 2024 presidential election drew ire from former President Donald Trump, the Republican candidate.

“To cut it by that much, assuming they’re not just playing politics, the economy would be very bad, or they’re playing politics,” Trump said Wednesday, speaking to reporters in a cryptocurrency-related bar in New York City.

Fed officials make their decisions independently of politics, and policymakers have been adamant that they ignore the political calendar when making decisions. But even if they have little to no ability to control the Fed’s actions, incumbents typically want to see low rates on their watch.

Besides sending a positive signal about the economy — at least in this case — lower Fed rates also help consumers. Mortgage rates have already been coming down in anticipation of the central bank’s rate cuts, making buying a home a bit easier for the typical household. (They are unlikely to return to the rock-bottom levels that prevailed in 2020, because the Fed is not expecting to cut rates back to near zero.)

The Fed will have to proceed with caution in the months ahead.

Some economists have worried that the central bank is already at risk of falling behind, because unemployment has risen to 4.2%, which is low by historical standards but up notably from 3.4% in early 2023.

Others have worried that by cutting interest rates rapidly, the Fed might speed the economy back up, causing inflation to get stuck at an uncomfortably high level. One Fed governor, Michelle W. Bowman, voted against Wednesday’s cut. She would have preferred a smaller rate move.

Powell made clear during his news conference that the Fed was willing to speed up or slow down its path of rate cuts if the economy proves weaker or stronger than expected. Policymakers want to nail the landing, he suggested, and are increasingly hopeful that they can.

“The U.S. economy is in a good place, and our decision today is designed to keep it there,” Powell said.

But while the Fed cut marked a big moment — and a step along the way — economists and analysts said that it was still too early to declare that the Fed had pulled off the soft landing.

“Saying that right now is like saying you’ve landed as you’re still in the middle of a ski jump,” said Gennadiy Goldberg, head of U.S. rates strategy at T.D. Securities. “We’re still very much up in the air.”

This article originally appeared in The New York Times.