特朗普将对电脑芯片和药品征收新关税

【中美创新时报2025 年 4 月 15 日编译讯】(记者温友平编译)特朗普政府周一采取的措施似乎可能导致对半导体和医药产品征收新的关税,这将增加唐纳德·特朗普总统对全球进口产品征收的关税。《纽约时报》记者Ana Swanson 和Tony Romm对此作了下述报道。

周一下午发布的联邦公告称,政府已对芯片和药品进口启动国家安全调查。特朗普暗示,这些调查可能导致加征关税。

调查还将涵盖用于制造半导体的机器、含有芯片的产品和药物成分。

白宫发言人库什·德赛在确认此举的声明中表示,总统“长期以来一直清楚制造业回流的重要性,这对我国的国家和经济安全至关重要”。

新的半导体和药品关税将根据 1962 年《贸易扩展法》第 232 条发布,该法案允许总统征收关税以保护美国国家安全。

周一早些时候,特朗普暗示他将很快对半导体和药品征收新的关税,因为他希望加强国内生产。

特朗普在白宫露面时对记者表示:“关税越高,它们进来得越快”,并提到了他对钢铁、铝和汽车征收的进口税。

半导体用于为电子产品、汽车、玩具和其他产品提供动力。美国严重依赖从台湾和亚洲其他地区进口的芯片,民主党和共和党都将这种依赖描述为国家安全面临的重大风险。

至于药品,特朗普认为太多重要药品依赖进口。“我们不再自己生产药品了,”他说。

尽管中国、爱尔兰和印度是某些类型药品的重要来源,但有些药品至少有一部分是在美国生产的。

特朗普周一还暗示,他可能会为某些公司提供关税减免,就像他最近几天对电子产品进口所做的那样——这与他过去坚持不会放过整个行业的做法不同。

总统表示,他“正在考虑一些措施来帮助一些汽车公司,这些公司正在转向使用在加拿大、墨西哥和其他地方生产的零部件。他们需要一点时间,因为他们必须在美国生产。” 通用汽车、福特汽车和Stellantis的股价在他发表讲话后大幅上涨。

“我是一个非常灵活的人。我不会改变主意,但我很灵活,”特朗普周一被问及可能的豁免时表示。他还补充说,他最近与苹果首席执行官蒂姆·库克进行了交谈,并“帮助”了他。

总统在过去一周宣布了其贸易议程的重大变化,此举引发了市场动荡,并吓坏了那些他试图说服在美国投资的企业。

4月2日,特朗普宣布了一项全球“互惠”关税计划,其中包括对越南等生产大量电子产品的国家征收高额关税。但在债券市场动荡之后,他暂停了这些全球关税90天,以便美国政府能够与其他国家进行贸易谈判。

除了这些进口税之外,特朗普还对多个行业和国家征收了其他关税,包括对所有美国进口产品征收10%的关税;对钢铁、铝和汽车征收25%的关税;以及对来自加拿大和墨西哥的许多商品征收25%的关税。总而言之,这些举措已将美国关税提高到一个多世纪以来的最高水平。

在与中国的贸易争端中,特朗普上周将中国进口商品的关税提高至至少145%,并于周五豁免了智能手机、笔记本电脑、电视机和其他电子产品。这些商品约占美国从中国进口商品的四分之一。

该政府辩称,此举只是“澄清”,并表示这些电子产品将纳入国家芯片安全调查范围。

但行业高管和分析师质疑,政府的真正动机是否是为了避免许多消费电子产品价格大幅上涨带来的反弹,或者是为了帮助苹果等科技公司,这些公司最近几天已经联系白宫,称关税将损害他们的利益。

特朗普利用232条款赋予的合法权力,对进口钢铁、铝和汽车征收关税。该政府还利用这一权力对木材和铜的进口进行调查。

周一发布的通知称,政府已于 4 月 1 日开始对药品和半导体进口进行调查。此前,白宫和总统都没有表示该程序已经正式开始。

白宫国家经济委员会主任凯文·哈塞特周一告诉记者,征收芯片关税是出于国家安全的需要。

“我喜欢举个例子,如果你有一门大炮,但炮弹是从对手那里获得的,那么一旦发生某种行动,你的炮弹就可能用完,”他说。“所以你可以对炮弹征收关税。”

特朗普认为,对芯片征收关税将迫使企业将工厂迁回美国。

一些科技公司响应了总统在美国扩大生产规模的要求。全球最大的芯片制造商台湾半导体制造股份有限公司今年3月在白宫宣布,未来四年将在美国投资1000亿美元扩大产能。

苹果公司宣布,未来四年将在美国投资 5000 亿美元扩建全国各地的工厂。

周一,芯片制造商英伟达宣布,将完全在美国生产用于人工智能的超级计算机。该公司表示,未来四年,将与台积电等公司合作,在美国生产价值高达5000亿美元的人工智能基础设施。

英伟达首席执行官黄仁勋在一份声明中表示:“世界人工智能基础设施的引擎首次在美国建造。”

白宫在一份声明中宣布了这一消息,并对总统表示赞扬。

声明称:“这就是特朗普效应在起作用。将这些行业转移到美国本土对美国工人有利,对美国经济有利,对美国国家安全也有利——而且最好的结果还在后头。”

但一些批评人士质疑,鉴于特朗普政府还威胁要取消拜登政府给予芯片工厂的补贴,关税究竟能对美国芯片产业有多大帮助。中国、日本、韩国和台湾等外国政府都通过补贴和税收减免等方式大力补贴半导体制造业。

根据全球半导体供应商协会SEMI汇编的数据,到2028年,全球预计将有105家新的芯片工厂(晶圆厂)上线。其中15家计划设在美国,其余大部分位于亚洲。

特朗普批评了《芯片法案》(CHIPS Act),该法案是拜登政府制定的一项500亿美元的计划,旨在为美国芯片制造业提供激励。他称这些补助浪费金钱,并坚称仅靠关税就足以鼓励国内芯片生产。

兰德公司技术分析高级顾问吉米·古德里奇表示,“如果使用得当,关税可能是有效的,作为振兴美国芯片制造业的更广泛战略的一部分,该战略包括国内制造和芯片购买优惠税收抵免,以及巧妙地限制即将到来的中国芯片供应过剩海啸”。

“然而,”他补充道,“美国本身仅占全球芯片商品需求的四分之一左右,因此与盟国合作至关重要。”

美国政府官员建议,芯片关税可能适用于通过其他设备进入美国的半导体。大多数芯片并非直接进口,而是在亚洲或墨西哥组装成电子产品、玩具和汽车零部件,然后再运往美国。

美国目前没有对封装在其他产品中的芯片征收关税的制度,但美国贸易代表办公室在拜登政府时期开始研究这个问题。芯片行业高管表示,建立这样的制度虽然困难,但并非不可能。

本文最初发表于《纽约时报》。

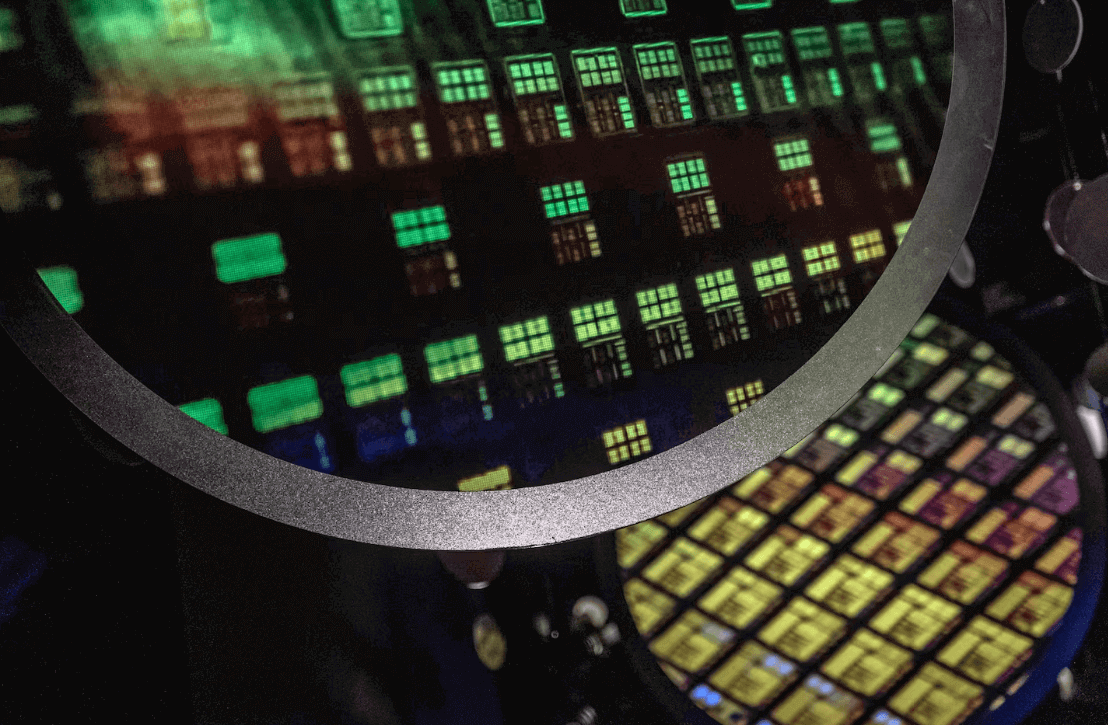

题图:中国新竹的半导体晶圆。 图片来源:LAM YIK FEI/NYT

附原英文报道:

Trump moves to put new tariffs on computer chips and drugs

By Ana Swanson and Tony Romm New York Times,Updated April 15, 2025

A semiconductor wafer in Hsinchu, China.LAM YIK FEI/NYT

WASHINGTON — The Trump administration took steps Monday that appear likely to result in new tariffs on semiconductors and pharmaceutical products, adding to the levies President Donald Trump has put on imports globally.

Federal notices put online Monday afternoon said the administration had initiated national security investigations into imports of chips and pharmaceuticals. Trump has suggested that those investigations could result in tariffs.

The investigations will also cover the machinery used to make semiconductors, products that contain chips and pharmaceutical ingredients.

In a statement confirming the move, Kush Desai, a White House spokesperson, said the president “has long been clear about the importance of reshoring manufacturing that is critical to our country’s national and economic security.”

The new semiconductor and pharmaceutical tariffs would be issued under Section 232 of the Trade Expansion Act of 1962, which allows the president to impose tariffs to protect U.S. national security.

Earlier Monday, Trump hinted that he would soon impose new tariffs on semiconductors and pharmaceuticals, as he looked to shore up more domestic production.

“The higher the tariff, the faster they come in,” Trump told reporters at a White House appearance, citing import taxes he has imposed on steel, aluminum and cars.

Semiconductors are used to power electronics, cars, toys and other goods. The United States is heavily dependent on chips imported from Taiwan and elsewhere in Asia, a reliance that Democrats and Republicans alike have described as a major risk to national security.

As for pharmaceuticals, Trump argued that too many vital medicines were imported. “We don’t make our own drugs anymore,” he said.

Some drugs are produced at least in part in the United States, though China, Ireland and India are significant sources of some types of pharmaceuticals.

Trump also signaled Monday that he could offer certain companies relief from his tariffs, as he did for electronics imports in recent days — a break from his past insistence that he would not spare entire industries.

The president said he was “looking at something to help some of the car companies, where they’re switching to parts that were made in Canada, Mexico and other places. And they need a little bit of time because they’ve got to make them here.” Shares of General Motors, Ford Motor and Stellantis jumped after his comments.

“I’m a very flexible person. I don’t change my mind, but I’m flexible,” Trump said Monday when asked about possible exemptions. He added that he had spoken to Apple CEO Tim Cook and “helped” him recently.

The president has announced significant changes over the past week to his trade agenda, which has roiled markets and spooked the businesses that he is trying to persuade to invest in the United States.

Trump announced a program of global, “reciprocal” tariffs April 2, including high levies on countries that make many electronics, like Vietnam. But after turmoil in the bond market, he paused those global tariffs for 90 days so his government could carry out trade negotiations with other countries.

Those import taxes came in addition to other tariffs Trump has put on a variety of sectors and countries, including a 10% tariff on all U.S. imports; a 25% tariff on steel, aluminum and cars; and a 25% tariff on many goods from Canada and Mexico. Altogether, the moves have increased U.S. tariffs to levels not seen in over a century.

Amid a spat with China, Trump raised tariffs on Chinese imports last week to a minimum of 145%, before exempting smartphones, laptops, TVs and other electronics Friday. Those goods make up about a quarter of U.S. imports from China.

The administration argued that the move was simply a “clarification,” saying those electronics would be included within the scope of the national security investigation on chips.

But industry executives and analysts have questioned whether the administration’s real motivation might have been to avoid a backlash tied to a sharp increase in prices for many consumer electronics — or to help tech companies, like Apple, that have reached out to the White House in recent days to argue that the tariffs would harm them.

Trump has used the legal authority under Section 232 to issue tariffs on imported steel, aluminum and automobiles. The administration is also using the authority to carry out investigations into imports of lumber and copper.

The notices Monday said the administration had begun its investigations into imports of pharmaceuticals and semiconductors April 1. Neither the White House nor the president previously said the process had officially begun.

Kevin Hassett, the director of the White House National Economic Council, told reporters Monday that the chip tariffs were needed for national security.

“The example I like to use is, if you have a cannon, but you’re getting the cannonballs from an adversary, then if there were to be some kind of action, then you might run out of cannonballs,” he said. “And so you can put a tariff on the cannonballs.”

Trump has argued that tariffs on chips will force companies to relocate their factories to the United States.

Some tech companies have been responsive to the president’s requests to build more in the United States. Taiwan Semiconductor Manufacturing Co., the world’s largest chip manufacturer, announced at the White House in March that it would spend $100 billion in the United States over the next four years to expand its production capacity.

Apple has announced that it will spend $500 billion in the United States over the next four years to expand facilities around the country.

On Monday, Nvidia, the chipmaker, announced that it would produce supercomputers for artificial intelligence made entirely in the United States. In the next four years, the company said, it will produce up to $500 billion of AI infrastructure in the United States in partnership with TSMC and other companies.

“The engines of the world’s AI infrastructure are being built in the United States for the first time,” Jensen Huang, Nvidia’s CEO, said in a statement.

The White House blasted out the news in an announcement that credited the president.

“It’s the Trump Effect in action,” the statement said. “Onshoring these industries is good for the American worker, good for the American economy and good for American national security — and the best is yet to come.”

But some critics have questioned how much tariffs will really help to bolster the U.S. industry, given that the Trump administration is also threatening to pull back on grants given to chip factories by the Biden administration. And foreign governments like China, Japan, South Korea and Taiwan all subsidize semiconductor manufacturing heavily with tools like grants and tax breaks.

Globally, 105 new chip factories, or fabs, are set to come online through 2028, according to data compiled by SEMI, an association of global semiconductor suppliers. Fifteen of those are planned for the United States, while the bulk are in Asia.

Trump has criticized the CHIPS Act, a $50 billion program established under the Biden administration and aimed at offering incentives for chip manufacturing in the United States. He has called the grants a waste of money and insisted that tariffs alone are enough to encourage domestic chip production.

Jimmy Goodrich, a senior adviser to the RAND Corp. for technology analysis, said tariffs could be effective “if used smartly, as part of a broader strategy to revitalize American chipmaking that includes domestic manufacturing and chip purchase preferential tax credits, along with clever ways to limit the coming tsunami of Chinese chip oversupply.”

“However,” he added, “the United States on its own only accounts for about a quarter of all global demand for goods with chips in them, so working with allied nations is critical.”

Administration officials have suggested that chip tariffs could be applied to semiconductors that come into the United States within other devices. Most chips are not directly imported — rather, they are assembled into electronics, toys and auto parts in Asia or Mexico before being shipped into the United States.

The United States has no system to apply tariffs to chips encased within other products, but the Office of the U.S. Trade Representative began looking into this question during the Biden administration. Chip industry executives say such a system would be difficult to establish, but possible.

This article originally appeared in The New York Times.