特朗普试图利用关税将自己的意志强加于经济。但这样做行不通

【中美创新时报2025 年 4 月 3 日编译讯】(记者温友平编译)特朗普总统的第二任期内,一直在利用行政权力将自己的意愿强加给移民、大学和政府机构。 但将自己的意愿强加给美国消费者和制造商则是一个截然不同的挑战,而且在政治上也更加危险。对此,《波士顿环球报》记者吉姆·普赞格拉作了下述报道。

特朗普周三宣布征收全面新关税,试图重塑美国经济,鼓励更多国内生产。

“通过今天的行动,我们终于能够让美国再次伟大,比以往任何时候都更伟大,”特朗普在白宫举行的“解放日”仪式上说道。“我们将增强国内工业基础。我们将打开国外市场,打破对外贸易壁垒。最终,国内生产增加将意味着竞争更加激烈,消费者价格更低。”

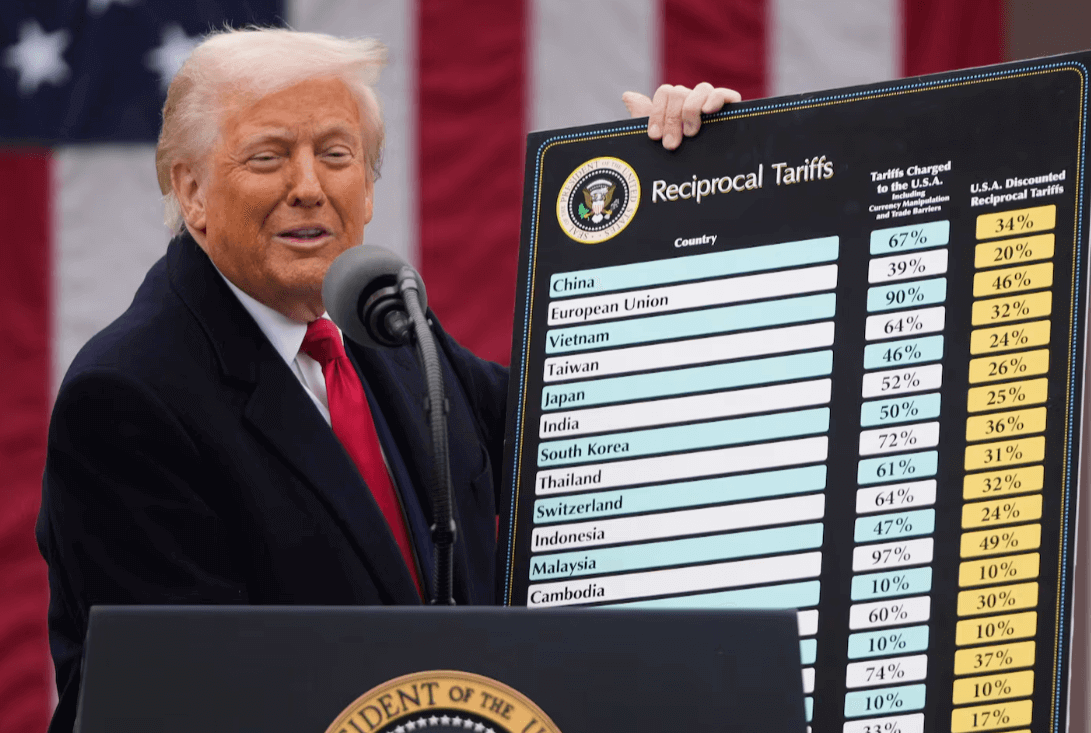

他宣布,从周四开始,美国将对进口产品征收更高的关税,最低为 10%,在某些情况下,关税会根据其他国家对美国产品的征收情况而有所提高。来自欧盟的商品将面临 20% 的关税,中国商品将被征收 34% 的关税。他说,所有外国制造的汽车都将被征收 25% 的关税。

经济学家表示,这些关税和已经实施的关税将在短期内导致价格上涨。但消费者、企业主、投资者和外国官员并不属于特朗普的行政权力范围。他也不能动用大笔一挥就命令人们继续购买商品。

他们已经表明不会屈服于特朗普的经济指令。

最近几周,特朗普提高了铝和钢铁等进口产品的关税,并宣称还将提高其他进口产品的关税,导致主要股指暴跌,消费者和企业信心下降。主要贸易伙伴也进行了反击,对美国出口产品征收关税。

所有不确定性以及对全球大规模贸易战的担忧,已导致经济学家大幅提升今年美国经济衰退的风险,因为关税导致的价格上涨预计会减缓支出和投资。

穆迪分析公司首席经济学家马克·赞迪表示: “今年年初,经济表现异常良好……几个月后,经济却因不确定的经济政策、全球贸易战、政府效率部随意削减就业和政府资金而陷入困境。”他将今年经济衰退的可能性从 1 月初预测的 15% 提高到 40%。

特朗普之所以当选,很大程度上是因为他承诺立即降低高物价,但他在经济方面的支持率却有所下降。美联社-NORC 公共事务研究中心周一公布的一项民意调查显示,只有 40% 的受访者认可他对经济的处理方式,58% 的人表示不满意——这是他自第一任期初期以来担任总统以来的最差数据。

经济学家表示,周三宣布的关税只会让特朗普的情况更糟,至少在短期内如此,因为这些关税是由美国进口商在外国商品进入美国时支付的。这些企业通常会将更高的价格转嫁给消费者。

“最初的担忧是许多商品的价格将迅速上涨,”共和党战略家道格·海耶 (Doug Heye) 表示。“对于一位在第一天就承诺要消除通货膨胀的候选人来说,这成了一个问题。”

周三晚间,四名共和党参议员与民主党参议员一同投票,阻止特朗普援引紧急权力提高对加拿大的关税,这一政治风险显而易见。共和党控制的参议院以 51 票赞成、48 票反对的结果通过了该法案, 这是对特朗普宣布加征关税数小时后做出的谴责 ,尽管该法案很可能在众议院受阻。

“我们得到了各界的支持,因为人们不希望美国人不得不为食品杂货、建筑材料和苹果派支付更多费用而苦苦挣扎,看在上帝的份上,”弗吉尼亚州民主党参议员、该法案的发起人蒂姆·凯恩周三表示。他说,Mom’s Apple Pie Co. 的老板告诉他,她担心卖出的苹果派会减少,因为美国的关税将导致来自加拿大的铝罐价格上涨 25%。Mom ‘s Apple Pie Co. 是一家面包店,在该州有三家分店。

民主党正在猛烈批评特朗普迄今为止未能降低价格, 以及新关税预计导致的价格上涨,他们称新关税相当于一项新的全国销售税。

众议院民主党领袖哈基姆·杰弗里斯周三对记者说:“这不是‘解放日’,而是美国的‘衰退日’。特朗普的关税政策将导致经济崩溃。”

关税传统上并未促进国内生产或经济增长,部分原因是其他国家通常会以自己的关税作出回应。1930 年《斯姆特霍利关税法》引发的全球贸易战导致严重的经济衰退演变为大萧条。

“在他的第一个任期内,关税的大部分成本由美国消费者承担,”赞迪在谈到特朗普 2017 年上任后征收的较为有限的关税时表示。“到 2019 年底,制造业陷入了衰退。”

关税的不确定性导致金融市场出现抛售。特朗普周三宣布的这一决定不会结束不确定性,因为他随时可能改变关税,而且他使用紧急权力实施关税的行为可能会受到法庭质疑。

投资咨询公司 Cresset Capital 的首席投资官杰克·阿布林 (Jack Ablin) 表示,特朗普非常了解股市,甚至在周三吹嘘股市在他第一任期内表现得多么出色,因此负面反应可能导致他像 1 月份那样退出。

“我认为特朗普总统不希望经济衰退或熊市以他的名字命名,”阿布林说。“所以我认为他正在关注。”

特朗普承认,美国民众可能会感受到关税带来的“一些痛苦”和“一点混乱”,但他最近淡化了股市下跌的影响。 “你真的不能盯着股市看,”他在 3 月份接受福克斯新闻采访时表示。

尽管如此,美国人并不认为关税有助于改善他们的经济状况。马凯特法学院周三公布的一项民意调查显示,58% 的成年人认为关税损害了美国经济,只有 28% 的人认为关税有帮助。

“他在玩弄政治火力,因为民意调查显示,他的经济状况已经呈下滑趋势,”民主党战略家西蒙·罗森伯格表示。“他承诺会降低物价,但他却违背了承诺,我认为选民不会对这些行动做出积极回应。”

特朗普认为,美国人需要忍受一些短期痛苦才能获得长期利益。问题是,经济学家表示,关税不太可能带来任何长期经济利益。

“你无法改变经济规律,”赞迪说。“你可以影响它,但你无法用行政命令改变它。”

题图:特朗普总统周三在白宫玫瑰园宣布了新的关税。Mark Schiefelbein/美联社

附原英文报道:

Trump is trying to use tariffs to impose his will on the economy. It doesn’t work like that.

By Jim Puzzanghera Globe Staff,Updated April 2, 2025

President Trump announced the new tariffs in the Rose Garden at the White House on Wednesday.Mark Schiefelbein/Associated Press

WASHINGTON — President Trump’s second term has been all about using executive authority to impose his will on immigrants, universities, and government agencies. But imposing his will on US consumers and manufacturers presents a much different — and more politically perilous — challenge.

In announcing sweeping new tariffs Wednesday, Trump is trying to reshape the US economy to encourage more domestic production.

“With today’s action, we are finally going to be able to make America great again, greater than ever before,” Trump said in a White House ceremony on what he dubbed “Liberation Day.” “We will supercharge our domestic industrial base. We will pry open foreign markets and break down foreign trade barriers. And, ultimately, more production at home will mean stronger competition and lower prices for consumers.”

Starting Thursday, the United States will levy significantly higher tariffs on imports, he declared, a minimum of 10 percent and in some cases higher based on what other countries charge on US products. Goods from the European Union will face a 20 percent tariff and Chinese goods will be hit with a 34 percent tariff. All foreign-made automobiles will be subject to a 25 percent tariff, he said.

Those tariffs and ones already in place will cause prices here to rise in the short term, economists said. But consumers, business owners, investors, and foreign officials don’t fall under Trump’s executive authority. And he can’t order people to keep buying goods with a stroke of his pen.

And they’ve already shown that they won’t bow to Trump’s dictates on the economy.

In recent weeks, major stock indices have tumbled while consumer and business confidence has declined after Trump increased tariffs on certain imports, such as aluminum and steel, and vowed that other higher tariffs were on their way. Major trading partners struck back, levying their own tariffs on US exports.

All the uncertainty and fears of a major global trade war have led economists to significantly boost the risk of a US recession this year as the higher prices caused by tariffs are expected to slow spending and investment.

“The economy came into the year performing exceptionally well and . . . a few months later it’s gagging on the uncertain economic policy, the global trade war, the haphazard [Department of Government Efficiency] cuts to jobs and government funding,” said Mark Zandi, chief economist at Moody’s Analytics. He raised the odds of a recession this year to 40 percent, from his 15 percent prediction in early January.

Trump, who was elected in large part on his promise to immediately reduce high prices, has seen his approval rating on the economy drop. A poll released Monday by the AP-NORC Center for Public Affairs Research found just 40 percent of respondents approve of his handling of the economy, with 58 percent disapproving — the worst numbers for him as president since early in his first term.

The tariffs announced Wednesday are only going to make matters worse for Trump, at least in the short term, economists said, because they are paid by US importers when foreign goods enter the country. Those businesses usually pass the higher prices on to customers.

“The initial concern is that prices are going to rise on a lot of goods very quickly,” said Republican strategist Doug Heye. “For a candidate who promised to end inflation on day one, that becomes problematic.”

The political risk was evident Wednesday night, when four Senate Republicans voted with Democrats to block the emergency powers Trump is citing to raise tariffs on Canada. The 51-48 passage by the Republican-controlled Senate was a rebuke to Trump just hours after his tariff announcement, even if it is likely to stall in the House.

“We have support left, right, and center, because people don’t want Americans to have to struggle to pay more for groceries, pay more for building supplies, pay more for apple pie, for God’s sake,” Virginia Democratic Senator Tim Kaine, the measure’s sponsor, said Wednesday. He said the owner of Mom’s Apple Pie Co., a bakery with three locations in his state, told him she fears selling fewer pies because US tariffs will cause the price of aluminum tins from Canada to increase by 25 percent.

Democrats are pounding away at Trump’s failure to bring down prices so far, and the price increases expected from the new tariffs, which they’ve labeled the equivalent of a new national sales tax.

“This is not ‘Liberation Day.’ It’s ‘Recession Day’ in the United States of America,” House Democratic Leader Hakeem Jeffries told reporters Wednesday. “That’s what the Trump tariffs are going to do — crash the economy.”

Tariffs traditionally have not boosted domestic production or economic growth, in part because other nations usually respond with their own tariffs. A global trade war caused by the Smoot-Hawley Tariff Act in 1930 helped turn a steep recession into the Great Depression.

“In his first term, the bulk of the [cost of] tariffs were borne by American consumers,” Zandi said of the more limited tariffs Trump imposed after he first took office in 2017. “Manufacturing was in a recession by the end of 2019.”

The uncertainty about the tariffs has led to a selloff in financial markets. Trump’s announcement Wednesday won’t end the uncertainty because he could change them at any moment and his use of emergency powers to impose them could be challenged in court.

Trump is very cognizant of the stock market, even boasting on Wednesday about how well it did during his first term, so a negative reaction could lead him to back down as he did in January, said Jack Ablin, chief investment officer at Cresset Capital, an investment advisory firm.

“I don’t think President Trump wants to have a recession or a bear market named after him,” Ablin said. “So I think he’s paying attention.”

Trump has acknowledged Americans could feel “some pain” and a “little disruption” from the tariffs while recently downplaying the market selloffs. “You can’t really watch the stock market,” he told Fox News in March.

Still, Americans aren’t sold on tariffs helping their economic situation. A Marquette Law School Poll released Wednesday found 58 percent of adults think tariffs hurt the US economy, with just 28 percent saying they help.

“He’s playing with political fire because he’s already in a downward trajectory” on the economy in the polls,” said Democratic strategist Simon Rosenberg. “He promised he would lower prices and he’s betrayed that promise and I don’t think voters are going to respond to these actions favorably.”

Trump has argued Americans needs to put up with some short-term pain for long-term gain. The problem is, economists say there’s unlikely to be any long-term economic gains from the tariffs.

“You can’t change the laws of economics,” Zandi said. “You can influence it, but you can’t change it with an executive order.”