特朗普称对加拿大、墨西哥和中国的关税将于3月4日生效

【中美创新时报2025 年 2 月 28 日编译讯】(记者温友平编译)特朗普总统周四表示,对来自加拿大和墨西哥的商品征收的关税将于 3 月 4 日大幅增加,同时出人意料地宣布对中国商品征收 10% 的额外关税,并将于当日生效。《华盛顿邮报》大卫·J·林奇对此作了下述报道。

总统在其社交媒体网站 Truth Social 上的一篇帖子中表示,他正在采取行动应对非法毒品的持续涌入。

“毒品仍在从墨西哥和加拿大大量涌入我国,数量之多令人无法接受。这些毒品中很大一部分(其中大部分是芬太尼)是在中国制造和供应的,”总统写道。“我们不能让这种祸害继续伤害美国。”

2 月初,特朗普宣布对加拿大和墨西哥商品征收 25% 的关税,但在与两国首脑讨论后,又将征收关税推迟了一个月。周四,特朗普宣布对中国商品征收 10% 的新关税,这是 2 月初生效的 10% 关税的补充。

最新举措将使部分中国商品的进口关税总额达到 45%。

最近几天,特朗普就其计划发出了相互矛盾的信号,似乎就在周三暗示,加拿大和墨西哥的关税可能会再次推迟到 4 月初。

但在与加拿大和墨西哥外交官的谈判仍在继续的同时,白宫官员重申,特朗普将实施新的进口税。

“这已经确定了,”这位不愿透露姓名的官员表示,以解释总统的想法。

周四的社交媒体声明似乎旨在澄清混乱的前景,但有迹象表明,总统几乎每天都在思考关税问题,这正在对消费者和投资者造成影响。

密歇根大学最新调查显示,消费者信心下降,未来通胀预期上升。与此同时,道琼斯工业平均指数在过去一个月下跌超过 3%,抹去了选举后的所有涨幅。

直到最近,华尔街基本上对特朗普的关税言论不以为然,认为这是一种旨在赢得外国让步的谈判策略。但随着总统将其目标从分散的外交政策目标扩大到增加政府收入和重塑全球贸易秩序的更广泛目标,舆论开始转变。

周四,摩根大通经济学家表示,特朗普最近的言论“增加了”部分关税实施的可能性。

除了特朗普周四确认的关税外,新的钢铁和铝进口税也定于 3 月 12 日生效。总统还承诺对欧盟商品以及汽车、半导体、铜和药品征收新税。

他还呼吁全面改革美国贸易政策,使其与其他国家对美国商品征收的关税相匹配,这可能会大幅增加贸易壁垒。周四,特朗普与来访的英国首相基尔·斯塔默一起出现在白宫,提出了两国之间免关税贸易的前景。

“我们最终可能会达成一项真正的贸易协议,不需要征收关税,”特朗普说。“我们拭目以待。”

总统发表了大量声明,让影响全球供应路线的决定悬而未决,许多公司对未来前景感到不确定。

“企业正在寻找某种确定性,然后他们会围绕它制定计划,”华盛顿盛德律师事务所的贸易律师泰德·墨菲说。

虽然总统经常声称外国人支付美国关税,但美国进口商在港口收取货物时向美国海关官员支付关税。最终,该税收的负担由美国进口商、外国生产商和最终客户分担,具体程度取决于具体的市场条件。

“特朗普正在把美国经济推向绝境,并希望美国家庭充当人体碰撞测试假人。对美国人从加拿大、墨西哥和中国购买的所有商品征收关税,将意味着食品杂货、汽油和汽车价格上涨,当我们最亲密的贸易伙伴通过购买更少的美国产品来应对特朗普的贸易战时,就业岗位会减少,工资也会降低,”参议院财政委员会资深民主党人、俄勒冈州参议员罗恩·怀登说。

在加拿大,总理贾斯汀·特鲁多誓言对价值高达 1070 亿美元的美国商品征收报复性关税,包括佛罗里达橙汁、肯塔基波本威士忌和宾夕法尼亚摩托车。加拿大政府表示,其他措施,包括对加拿大向美国出口能源征税或限制,也是可能的。

“我们将立即做出极其强烈的回应,”特鲁多周四在蒙特利尔告诉记者。

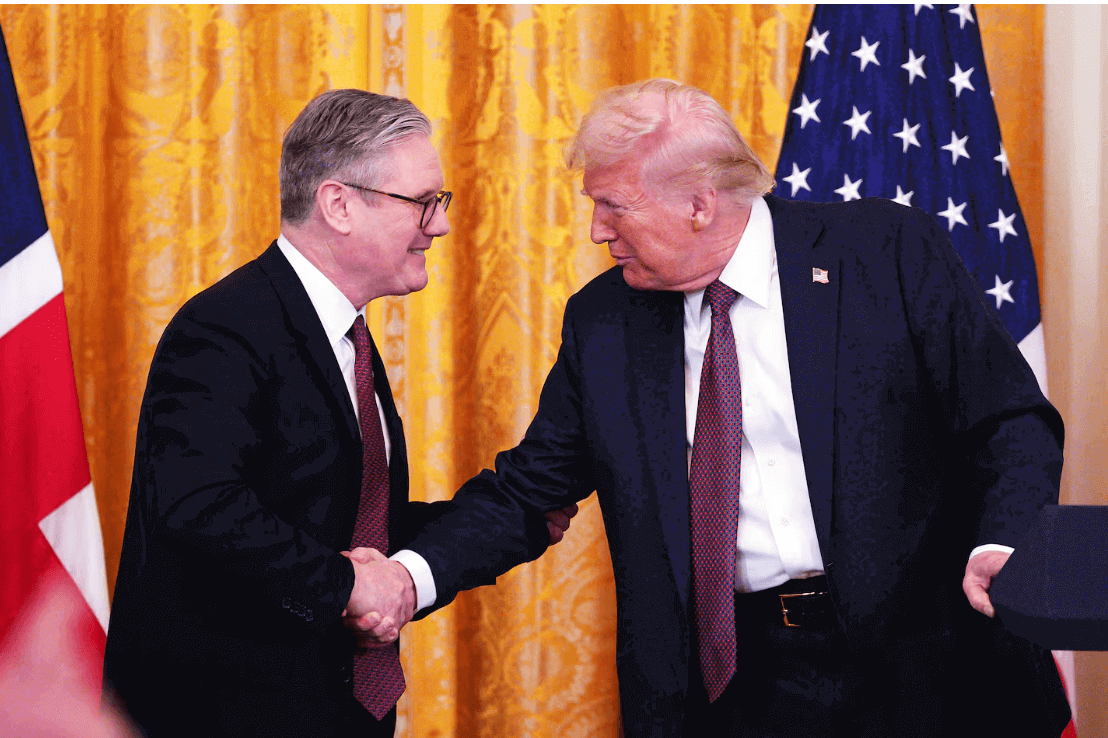

题图:英国首相基尔·斯塔默(左)和美国总统唐纳德·特朗普在白宫东厅举行的联合新闻发布会上握手。Carl Court/美联社

附原英文报道:

Trump says tariffs on Canada, Mexico, and China will take effect Tuesday

By David J. Lynch The Washington Post,Updated February 27, 2025

Britain’s Prime Minister Keir Starmer, left, and US President Donald Trump shook hands at a joint press conference in the East Room at the White House.Carl Court/Associated Press

President Trump said Thursday that tariffs on goods from Canada and Mexico will increase sharply on March 4 and, in an unexpected move, also announced an additional 10 percent tax on Chinese goods that would take effect then.

In a post on his social media site Truth Social, the president said he was acting to confront a continuing influx of illicit drugs.

“Drugs are still pouring into our Country from Mexico and Canada at very high and unacceptable levels. A large percentage of these Drugs, much of them in the form of Fentanyl, are made in, and supplied by, China,” the president wrote. “We cannot allow this scourge to continue to harm the USA.”

In early February, Trump announced 25 percent levies on Canadian and Mexican merchandise and then delayed them by one month after discussions with the heads of those countries. The new 10 percent tax on Chinese goods that he declared Thursday is in addition to a 10 percent levy that took effect in early February.

The latest action will bring the total import fee on some Chinese goods to 45 percent.

In recent days, Trump has given conflicting signals about his plans, appearing to suggest as recently as Wednesday that the Canada and Mexico tariffs might be delayed again until early April.

But while talks continue with Canadian and Mexican diplomats, a White House official reiterated that Trump is set on imposing the new import taxes.

“This is locked in,” said the official, speaking on the condition of anonymity to explain the president’s thinking.

Thursday’s social media statement, which seemed designed to clarify a muddled outlook, comes amid signs that the president’s near daily musings on tariffs are taking a toll on consumers and investors.

Consumer confidence dipped and expectations of future inflation rose in the latest University of Michigan survey. At the same time, the Dow Jones industrial average has dropped more than 3 percent in the last month, surrendering all of its post-election gains.

Until recently, Wall Street largely shrugged off Trump’s tariff talk, seeing it as a negotiating strategy designed to win concessions from foreign nations. But as the president has widened his goals from discrete foreign policy objectives to broader aims of raising significant government revenue and reshaping the global trade order, opinion is starting to shift.

On Thursday, economists at J.P. Morgan said Trump’s recent remarks were “increasing the odds” that some tariffs will be implemented.

Along with the tariffs Trump confirmed Thursday, new import taxes on steel and aluminum are scheduled to take effect on March 12. The president also has promised to impose new taxes on goods from the European Union and on automobiles, semiconductors, copper, and pharmaceuticals.

He has also called for a comprehensive overhaul of US trade policy that will match the tariffs other countries apply to American goods, which could dramatically escalate trade barriers. Appearing with visiting British Prime Minister Keir Starmer on Thursday at the White House, the president dangled the prospect of tariff-free trade between the two nations.

“We could very well end up with a real trade deal where the tariffs wouldn’t be necessary,” Trump said. “We’ll see.”

The blizzard of presidential statements, leaving decisions affecting global supply routes to be determined, has many companies unsure about their future prospects.

“Businesses are looking for some semblance of certainty and then they’ll plan around it,” said Ted Murphy, a trade attorney at Sidley Austin in Washington.

While the president often claims that foreigners pay US tariffs, it is American importers who pay them to US customs officials when they collect goods at ports. Ultimately, the burden of that tax is shared by the American importer, the foreign producer, and the final customer, to varying degrees depending upon specific market conditions.

“Trump is driving the US economy straight into a wall and expecting American families to serve as human crash test dummies. Slapping tariffs on everything Americans buy from Canada, Mexico, and China will mean higher prices on groceries, gas, and cars, with fewer jobs and lower pay when our closest trading partners respond to Trump’s trade war by buying fewer American products,” said Senator Ron Wyden of Oregon, the senior Democrat on the Senate Finance Committee.

In Canada, Prime Minister Justin Trudeau has vowed to impose retaliatory tariffs on up to $107 billion worth of US goods, including Florida orange juice, Kentucky bourbon, and Pennsylvania motorcycles. Other measures, including taxes or limitations on Canadian energy exports to the United States, also are possible, the Canadian government has said.

“We will have an immediate and extremely strong response,” Trudeau told reporters in Montreal on Thursday.