【中美创新时报2024 年 11 月 26 日编译讯】(记者温友平编译)“关税是有史以来最伟大的发明,”特朗普宣称。但北桥公司 Riverdale Mills 却并非如此。《波士顿环球报》记者Hiawatha Bray对此作了如下详细报道。

对于当选总统唐纳德·特朗普来说,这笔账似乎很简单:对在美国销售的外国制造商品征收高额关税将为联邦政府带来数十亿美元的收入,同时促进国内制造商的发展并带来经济繁荣。

特朗普还指望关税成为迫使美国贸易伙伴屈服于他意愿的武器。周一,他威胁要对来自加拿大和墨西哥的商品征收 25% 的关税,除非这两个国家阻止非法毒品和移民越境进入美国。特朗普还表示,除非中国阻止非法毒品走私到美国,否则他将对中国进口商品提高 10% 的关税。

“关税是有史以来最伟大的发明,”特朗普宣称。

但北桥公司 Riverdale Mills 却并非如此,该公司拥有 120 名员工,生产钢丝网,用于从家用围栏到龙虾笼等多种用途。特朗普第一任期内对钢铁征收的关税重创了公司的利润。

由于担心市场份额下降,该公司没有裁员或提高价格。但它削减了对新设备的投资。一项针对中国进口产品的单独关税计划有助于提高 Riverdale 的国内销售,但当中国以自己的关税作出回应时,该公司再次受到打击。

特朗普支持征收巨额新关税。它们是什么?它们是如何运作的?

“我们努力解决了这个问题,”Riverdale 首席执行官 James Knott Jr. 说。“但我们的盈利能力不如我们所希望的那样。”

诺特的故事与其他制造商和经济学家的故事如出一辙,他们表示,特朗普的第一波关税对国内制造商几乎没有带来任何好处,而国内制造商正是关税旨在帮助的关键市场领域之一。

“有利有弊,但我认为从全球范围来看,弊端更多,”Lutco 董事长约翰·斯托 (John Stowe) 表示。Lutco 是一家位于伍斯特的定制钢轴承和机械零件制造商,拥有约 120 名员工。

麻省理工学院等多所大学的经济学家于 1 月发表了一篇论文,结论是“对中国和其他外国商品征收进口关税对美国就业既没有显著影响,也没有显著影响”,当中国提高关税作为报复时,美国失去了就业机会,尤其是在农业领域。

制造商怀疑,如果特朗普兑现威胁,最终对大多数进口产品征收 20% 的关税,对来自中国的商品征收 60% 至 100% 的关税,情况会不会有所不同。

“如果他们这样做,将造成极大的破坏,”斯托说。

很难衡量关税在相互交织的全球经济中的整体影响。即使公司主要在美国生产和销售产品,它们也需要来自海外的原材料和供应。对于那些依赖海外销售的公司来说,报复性关税的威胁迫在眉睫。

2023 年,中国是马萨诸塞州公司的第二大出口市场,购买了价值 33 亿美元的商品,包括工业机械、医疗设备和药品。如果中国对美国关税上调进行报复,该州的经济将遭受巨大损失。

关税本质上是美国企业进口商品所缴纳的税款。它们要么以更高的价格直接转嫁给消费者,要么全部或部分被卖家吸收,从而削减他们的利润。它们还可以使在美国境内生产和销售的商品相对于进口产品更便宜。

关税本应激励企业和消费者“购买美国产品”。但包括 Lutco 和 Riverdale 在内的许多制造商在其部分产品中使用了中国零部件,因此它们需要承担更高的关税成本。

联邦法律赋予总统相当大的自由度,无需国会干预即可制定关税。因此,特朗普可以下令征收 60% 甚至更高的关税,也可以接受较小的增幅。

虽然特朗普本周的帖子让人们初步了解了他的计划,但有充分的理由相信他的计划可能会改变。特朗普的支持者、对冲基金经理比尔·阿克曼 (Bill Ackman) 在 X 上的一篇帖子中表示,特朗普将利用对墨西哥和加拿大征收关税的威胁作为谈判工具。

阿克曼说,特朗普“将利用关税作为武器,实现符合美国最佳利益的经济和政治结果,实现他的美国优先政策。”

专门从事贸易事务的律师事务所 Sandler, Travis & Rosenberg 波士顿办事处的高级成员 Paula Connelly 表示,她已经收到该州许多企业的咨询请求。

“最大的问题……是不确定性,”Connelly 说。“我们从客户那里听到的是,我们该怎么办?”

Knott 说,一种选择是在特朗普上任前储备物资。但这意味着要花掉额外的现金。Knott 说,在利率上升的时候,一些公司可能不得不借钱来购买物资。

或者,公司可以争先恐后地从关税较低的国家寻找替代品。但更换供应商本身就很复杂,成本很高。而且在很多情况下,没有好的替代品。

Lutco 的一些滚珠轴承组件是中国制造的,这迫使该公司将至少部分关税成本转嫁给客户。Stowe 说,他的公司正在寻找替代来源,可能位于印度。

制造商不可能为中国产品多支付 60% 的费用,而不转嫁至少一部分额外成本。他们不能直接转向更便宜的国内供应商;通常没有美国公司生产他们所需的产品。

因此,Riverdale 和 Lutco 等公司将继续购买一些受关税影响的中国产品,从而推高其价格并侵蚀其利润。两家公司都预计中国将以更高的关税进行反击,这将损害他们在中国的销售。

“这不是世界末日,”斯托说,他预测他的公司最终会找到走出关税迷宫的出路。但“我认为这不会帮助美国工业。”

当第一届特朗普政府对价值 3800 亿美元的中国商品征收高达 25% 的关税时,中国对包括龙虾在内的多种美国商品征收关税进行反击。结果是美国龙虾出口急剧下滑,进而打击了对 Riverdale 龙虾笼钢丝网的需求。

尽管特朗普政府对 Riverdale 用于制造网状物的进口钢材征收了 25% 的关税,但这种情况仍然发生了。

“我们受到了双重打击,”诺特说。“我们的钢材成本从每吨 540 美元上涨到每吨 940 美元。然后中国对龙虾征收关税。然后龙虾捕捞者无法将龙虾运到中国,因为它们更贵了。”当然,对龙虾的需求减少意味着对 Riverdale 金属丝网制成的龙虾笼的需求也减少了。

2020 年,美国-墨西哥-加拿大自由贸易协定允许 Riverdale 从加拿大钢厂购买低成本的免关税钢材,情况有所改善。此后,对中国的关税带来了一些好处。

“它们有助于提高外国进口产品对美国买家的价格,”诺特说,从而增加了其公司网状产品的销量。但 Riverdale 从中国购买化学品和少量钢铁,所有这些都要缴纳关税,这侵蚀了 Riverdale 的利润。

Riverdale 设法忍受了特朗普最初的关税。“我认为他第一届政府的一切已经稳定下来,并且已经达到了平衡,”诺特说。

但他对大幅提高关税是否有效持怀疑态度。“说实话,我认为这不现实,”诺特说,他从经验中了解到中国有能力并且愿意反击。

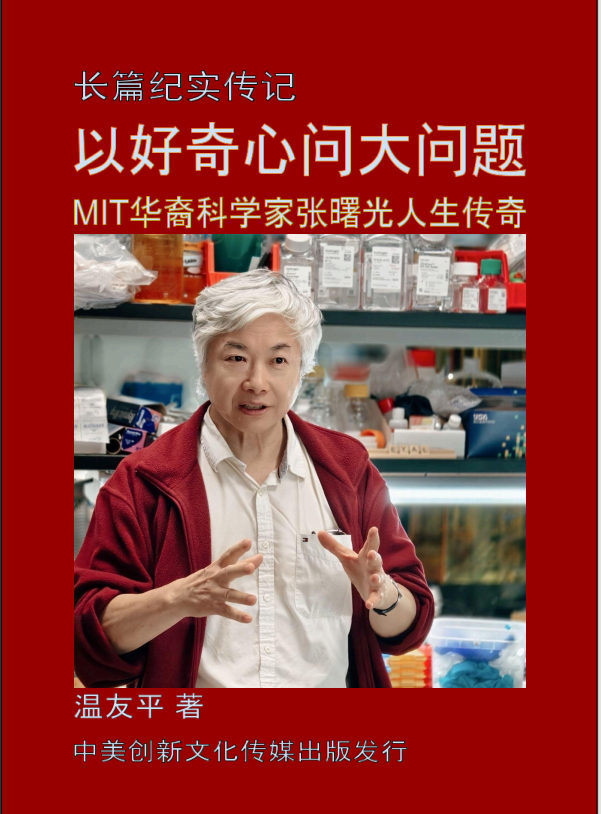

题图:Riverdale Mills 首席执行官 James Knott 站在他的公司制造的焊接钢丝网前,龙虾捕捞者和其他渔业从业者都在使用这种钢丝网。Jessica Rinaldi/Globe 工作人员

附原英文报道:

Trump has called tariffs ‘the greatest thing ever invented.’ Local manufacturers aren’t so sure.

By Hiawatha Bray Globe Staff,Updated November 26, 2024

Riverdale Mills CEO James Knott stood in front of the welded steel mesh made by his company and used by lobstermen and others in the fishing business.Jessica Rinaldi/Globe Staff

For President-elect Donald Trump, the math seems pretty simple: Slapping high tariffs on foreign-made goods sold in the United States will generate billions in revenue for the federal government, while boosting domestic manufacturers and generating an economic boom.

Trump is also counting on tariffs as a weapon to bend US trading partners to his will. On Monday, he threatened to levy a 25 percent tariff on goods from Canada and Mexico unless the two countries stop illegal drugs and migrants crossing into the United States. Trump also said he would raise tariffs on Chinese imports by 10 percent unless that country prevents the smuggling of illegal drugs into the United States.

“Tariffs are the greatest thing ever invented,” Trump has declared.

But it hasn’t felt that way at Riverdale Mills, a Northbridge company that employs 120 workers who make steel wire mesh used in many applications, from household fences to lobster traps. Tariffs on steel imposed during Trump’s first term hammered the company’s profits.

The company didn’t lay off workers or raise prices, fearing a loss of market share. But it slashed investment in new equipment. A separate tariff program targeting imports from China helped by boosting Riverdale’s domestic sales, but the company took another beating when China responded with its own tariffs.

Trump favors huge new tariffs. What are they, and how do they work?

“We worked through it, said Riverdale chief executive James Knott Jr. “But we weren’t as profitable as we’d like to be.”

Knott’s story echoes that of other manufacturers and economists, who say the first wave of Trump tariffs brought little benefit to domestic manufacturers — one of the key market sectors tariffs are intended to help.

“There are pluses and minuses, but I would consider on a world basis, there are more minuses,” said John Stowe, chairman of Lutco, a Worcester maker of custom steel bearings and machined parts that employs about 120 workers.

A paper published in January by economists from several universities, including MIT, concluded that “import tariffs on Chinese and other foreign goods had neither a sizable nor significant effect on US employment,” and that when China boosted its tariffs in retaliation, the United States lost jobs, especially in the agriculture sector.

Manufacturers doubt it will be any different if Trump goes through with his threats to eventually set a 20 percent tariff on most imported products, and tariffs of 60 to 100 percent on merchandise from China.

“It’ll be disruptive as hell if they do that,” Stowe said.

It’s difficult to gauge the overall impact of tariffs in an interwoven global economy. Companies need raw materials and supplies from overseas, even if they make and sell products primarily in the United States. And for those that depend on overseas sales, the threat of retaliatory tariffs looms.

China was the second-biggest export market for Massachusetts companies in 2023, purchasing $3.3 billion in goods including industrial machinery, medical equipment, and pharmaceuticals. The state’s economy has a lot to lose if China retaliates against a US tariff hike.

Tariffs are essentially a tax paid by US businesses that import goods. They are either passed directly on to consumers in the form of higher prices, or eaten in whole or part by the sellers, cutting into their profits. They can also make goods manufactured and sold within the United States less expensive relative to imported products.

Tariffs are supposed to give businesses and consumers an incentive to “buy American.” But many manufacturers, including Lutco and Riverdale, use Chinese components in some of their products, making them subject to higher tariff costs.

Tariffs are supposed to give businesses and consumers an incentive to “buy American.” But many manufacturers, including Lutco and Riverdale, use Chinese components in some of their products, making them subject to higher tariff costs.

Federal law gives the president considerable leeway in setting tariffs without input from Congress. So Trump could order tariffs of 60 percent or even higher, or he might settle for smaller increases.

While Trump’s posts this week provided an initial glimpse of his plans, there’s plenty of reason to believe they could change. Hedge fund manager Bill Ackman, a Trump supporter, said in a post on X that Trump will use the threat of tariffs on Mexico and Canada as a negotiating tool.

Trump, Ackman said, “is going to use tariffs as a weapon to achieve economic and political outcomes which are in the best interest of America, fulfilling his America first policy.”

Already, Paula Connelly, senior member in the Boston office of Sandler, Travis & Rosenberg, a law firm specializing in trade matters, said she’s getting pleas for advice from many business in the state.

“The biggest issue . . . is the uncertainty,” said Connelly. “What we’re hearing from our clients is, what do we do?”

One option, Knott said, is to stock up before Trump takes office. But that means burning through extra cash. Knott said some companies might have to borrow money for that at a time of higher interest rates.

Or companies can scramble to find alternatives from countries with lower tariffs. But switching suppliers is itself complicated and costly. And in many cases, there are no good substitutes.

Some of Lutco’s ball bearing assemblies are Chinese-made, forcing the company to pass on at least some tariff costs to customers. Stowe said his company is looking for alternative sources, possibly based in India.

It would be impossible for manufacturers to pay 60 percent more for Chinese products without passing on at least some of the extra cost. They can’t just switch to a cheaper domestic supplier; often there are no US firms that make what they need.

So companies such as Riverdale and Lutco will keep buying some tariff-affected Chinese products, driving their prices higher and eating into their profits. And both companies expect China to retaliate with higher tariffs that’ll harm their Chinese sales.

“It would not be the end of the world,” said Stowe, who predicted his company would eventually find its way through the tariff maze. But, “I don’t think it’s going to help American industry.”

When the first Trump administration imposed tariffs of up to 25 percent on $380 billion in Chinese goods, China retaliated with tariffs on a variety of US goods, including lobsters. The result was a dramatic slump in US lobster exports, which in turn hit demand for Riverdale’s steel mesh for lobster traps.

That happened even as the Trump administration levied a 25 percent tariff on the imported steel Riverdale uses to make the mesh.

“We got hit in two ways,” said Knott. “Our steel costs went up from $540 a ton to $940 a ton. And then the Chinese put tariffs on the lobsters. And then the lobstermen were unable to ship their lobsters to China because they were more expensive.” And of course, less demand for lobster meant less demand for the lobster traps made of Riverdale wire mesh.

Conditions improved after a US-Mexico-Canada free trade agreement in 2020 that allowed Riverdale to buy lower-cost tariff-free steel from Canadian mills. After that, the tariffs against China brought some benefit.

“They helped to make the foreign imports more expensive to US buyers,” Knott said, increasing sales of his company’s mesh products. But Riverdale purchases chemicals and a small amount of steel from China, all of it subject to tariffs that eat into Riverdale’s profits.

Riverdale has managed to live with the original Trump tariffs. “I think everything from his first administration has settled down and it’s kind of reached its equilibrium,” said Knott.

But he’s skeptical a big boost in tariffs would work. “I don’t think it’s realistic, to tell the truth,” said Knott, who has learned from experience that China is able and willing to strike back.