【中美创新时报2024 年 11 月 21 日编译讯】(记者温友平编译)马萨诸塞州经济发展法案中的一项措施为在韦斯特菲尔德(Westfield)建造一个大型数据中心铺平了道路,该中心将是该州最大的数据中心。《波士顿环球报》记者Jon Chesto 对此作了下述报道。

那么哪家大型科技公司将在韦斯特菲尔德建立大型业务?会是亚马逊、Alphabet 还是微软?

州议会上周批准了一项措施,免除数据中心的州销售税和使用税。据 Westmass 地区开发公司总裁 Jeff Daley 称,位于斯普林菲尔德以西约 15 英里的 Westfield-Barnes 地区机场附近的一个大型项目正在推进中。

Westfield 数据中心预计在全面建成后将耗资超过 30 亿美元,将是该州迄今为止最大的此类综合体,更不用说它是任何类型的最大私营部门项目之一。随着时间的推移,将有多达 10 座建筑物建成,里面装满了用于存储和处理数据的计算机服务器。

两年前,Westmass 帮助数据中心开发商 Servistar Realties 获得了城市规划委员会的批准以及市议会的重大税收减免。Servistar 还与当地市政公用事业公司 Westfield Gas & Electric 达成了一项电力购买协议,这将使其能够获得低于市场的电价。但 Daley 表示,销售税豁免是达成交易所必需的一个重要组成部分,就像美国一半以上的州为数据中心提供的一样。

随着上周州议会通过一项新的经济发展法案,情况发生了变化;该法案包括数据中心的销售税豁免,并于周三由州长 Maura Healey 签署成为法律。波士顿最繁忙的游说公司 Smith, Costello & Crawford 代表 Servistar 参加了州议会谈判。

数据中心开发商长期以来一直避开新英格兰,很大程度上是因为这里的电费高昂。但戴利认为,销售税豁免将刺激其他项目,除了 Westfield 的项目,还将刺激其他由市政电力公司服务的城市和城镇的项目,尤其是那些位于电网战略位置的项目(就像 Westfield 的站点一样)。

戴利说,他在法案通过后的第二天,即周五与代表 Servistar 投资者的康涅狄格州律师保罗·科里 (Paul Corey) 进行了交谈。科里告诉戴利,他本周正在与数据中心综合体的几位潜在主要租户进行交谈。戴利表示,他不知道具体的公司名称,只知道该国许多最大的数据中心用户都表示了兴趣——其中包括亚马逊、谷歌母公司 Alphabet 和微软等。

“他的一句话是,‘如果没有这些税收优惠,这一切都不会向前推进,’”戴利说。“如果没有这些优惠,他们甚至不会考虑马萨诸塞州。”

该项目是在最近人工智能热潮促使许多大型科技公司投入更多资金扩大数据中心能力之前提出的。麦肯锡公司最近的一项分析显示,到 2030 年,美国对数据中心容量的需求将比现在的水平增加两倍多。

戴利表示,这 10 座数据中心大楼将在 20 年内建成,最终占地 270 万平方英尺。他说,人工智能热潮可能会加速这一时间表。由于需要定期升级设备,戴利表示,销售税豁免每年可为未来的数据园区业主节省高达 3000 万美元。戴利表示,建设可能在 2026 年初开始,第一栋建筑可能需要大约 18 个月才能完工。

Servistar 以该项目所在的道路命名,很可能会将占地 155 英亩的开发项目出售给一家国家数据中心运营商,然后该运营商将部分或大部分建筑出租给一家大型科技公司,同时寻找较小的用户来共享这些建筑。戴利说,根据该市的税收减免计划,业主将在 40 年内向 Westfield 支付高达 3.72 亿美元的房产税,同时每年还能为他们节省数百万美元。最终,多达 400 人可以全职在那里工作。

由西斯普林菲尔德众议员迈克尔·芬恩 (Michael Finn) 发起的经济发展法案中的条款将免除合格数据中心长达 30 年的销售税。芬恩发表声明称,该法案“代表着确保马萨诸塞州在数字经济中保持竞争力的重要一步”。韦斯特菲尔德参议员约翰·维利斯 (John Velis) 在参议院提出了类似的法案。

“我真的认为这是一个改变游戏规则的法案,不仅仅是对马萨诸塞州西部来说,”戴利说。 “它为马萨诸塞州开辟了一个全新的技术领域,使其能够与其他州进行竞争。”

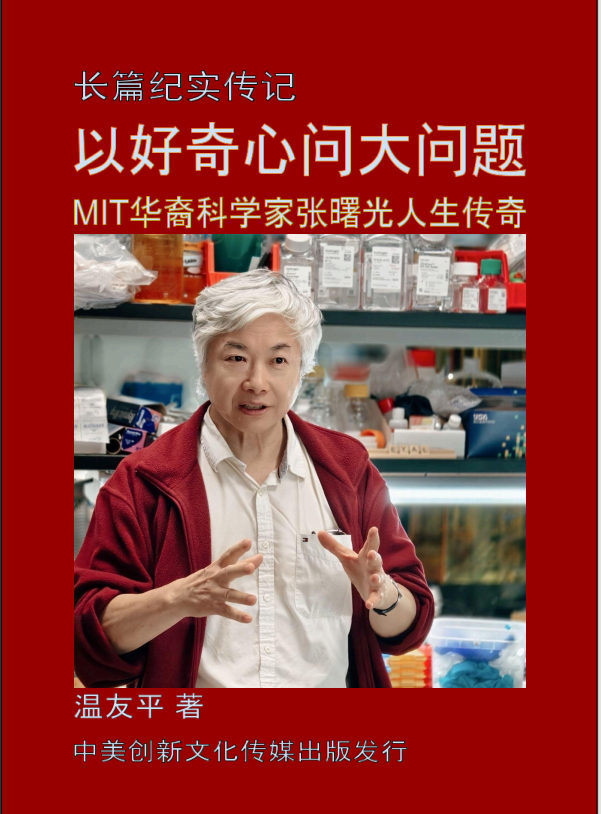

题图:经济发展法案中的一项措施为在韦斯特菲尔德建造一个大型数据中心铺平了道路,该中心将是该州最大的数据中心。下图是这些数据中心建筑的效果图。插图由 Westmass 提供

附原英文报道:

A multibillion-dollar data center project is coming to Western Mass.

By Jon Chesto Globe Staff,Updated November 20, 2024

A measure in the economic development bill paves the way for a massive data center, the largest in the state, to be built in Westfield. Pictured here is a rendering of what those data-center buildings would look like.Illustration courtesy of Westmass

So which giant tech company is going to set up a major operation in Westfield? Will it be Amazon, Alphabet, or maybe Microsoft?

The state Legislature last week approved a measure that exempts data centers from the state’s sales and use tax. And a massive project near the Westfield-Barnes Regional Airport, about 15 miles west of Springfield, is moving ahead as a result, according to Jeff Daley, president of the Westmass Area Development Corp.

Estimated to cost more than $3 billion at full buildout, the Westfield data center would be the largest such complex in the state by far, not to mention one of the largest private-sector projects of any type. As many as 10 buildings packed with computer servers for storing and processing data would be built there over time.

Westmass helped the data-center developer, Servistar Realties, secure approval from the city’s planning board as well as a major tax break from the city council two years ago. Servistar also negotiated a power purchase agreement with the local municipal utility, Westfield Gas & Electric, that will allow it to receive below-market electric rates. But a sales tax exemption, like what is offered to data centers in more than half of US states, was a big missing component necessary to make the deal happen, Daley said.

That changes with the passage of a new economic development bill last week at the State House; that bill, which includes the sales tax exemption for data centers, was signed into law by Governor Maura Healey on Wednesday. Servistar was represented in State House negotiations by Smith, Costello & Crawford, Boston’s busiest lobbying firm.

Data center developers have long steered clear of New England, in large part because of the high cost of electricity here. But Daley argues that the sales-tax exemption will spur other projects, beyond the one in Westfield, in other cities and towns served by a municipal electricity utility, particularly those that are strategically located on the electric grid (as the Westfield site is).

Daley said he spoke to Paul Corey, a Connecticut lawyer who represents the investors in Servistar, on Friday, the day after the bill passed. Corey told Daley that he is having conversations this week with several potential anchor tenants for the data center complex. Daley said he doesn’t know the specific company names, other than many of the biggest data-center users in the country have expressed an interest — a group that includes the likes of Amazon, Google parent Alphabet, and Microsoft.

“One of his quotes was, ‘None of this would have moved forward without these tax incentives,’ ” Daley said. “They won’t even look at Massachusetts without that being on the books.”

The project was proposed before the recent boom in artificial intelligence prompted many of the big tech players to devote even more capital to expanding data center capabilities. A recent analysis from McKinsey & Co. shows demand for data-center capacity more than tripling in the US by 2030 from today’s levels.

Daley said the 10 data-center buildings would go up over two decades, eventually spanning 2.7 million square feet of space. He said the AI boom would likely accelerate that timeline. Because of the need for regular equipment upgrades, Daley said the sales tax exemption could save the future data-park owners up to $30 million a year. Construction could start by sometime in early 2026, Daley said, and the first building would likely take around 18 months to complete.

Servistar, named after the road where the project would go up, will most likely sell the 155-acre development to a national data center operator, which would then lease some or most of the buildings to a big tech company, while also hunting for smaller users to share those buildings. Under the city’s tax break plan, the owners would pay up to $372 million in property taxes to Westfield over 40 years, Daley said, while also saving them millions of dollars a year. Eventually, as many as 400 people could work there on a full-time basis.

The provision in the economic development bill, sponsored by Representative Michael Finn of West Springfield, would exempt qualified data centers from sales taxes for up to 30 years. Finn issued a statement saying the bill “represents a major step forward in ensuring Massachusetts remains a competitive player in the digital economy.” Senator John Velis of Westfield filed a similar bill in the Senate.

“I honestly think it’s a game changer, not only for Western Mass.,” Daley said. “It opens up a whole other sector of technology for Massachusetts to compete with other states.”