【中美创新时报2024 年 6 月 22 日编译讯】(记者温友平编译)马萨诸塞州注册会计师协会(MassCPAs)表示,自选民批准“百万富翁税”以来,许多会计师都看到高收入客户离开该州。对此,《波士顿环球报》记者乔恩·切斯托(Jon Chesto) 作了下述报道。

一个会计师行业组织正在计算所谓的百万富翁税对该州经济的影响。早期的回报——至少从他们的角度来看——并不好看。

马萨诸塞州注册会计师协会本周发布的调查结果显示,三分之二的会员报告称,去年至少有一位客户离开了马萨诸塞州,这是对高收入者征收所得税附加税的第一年。90% 的人表示,他们还有其他客户正在考虑在明年离开该州。几乎所有人都表示,百万富翁税是他们客户考虑离开的决定因素之一,三分之一的人表示这是主要原因。超过一半的人表示,最有可能离开的客户年龄在 30 至 60 岁之间。

自从马萨诸塞州选民于 2022 年 11 月批准百万富翁税以来,MassCPAs 等商业团体一直在分享有关它如何促使富裕居民离开的轶事,通常是前往新罕布什尔州或佛罗里达州等免征所得税的州。但实际数据很少,而且到目前为止,附加税的税收已经超过了州政府的预测。

这项附加税为该州 5% 的年收入超过 100 万美元的所得税增加了 4 个百分点,收益将用于交通和教育。由教师工会支持的联盟“振兴马萨诸塞州”(Raise Up Massachusetts )领导的倡导者认为,在这些事业上花钱带来的经济效益足以抵消任何负面影响。

到目前为止,很难获得确切的数据;国税局最近公开的移民数据早于百万富翁税投票。但 MassCPAs 首席执行官扎克·多纳(Zach Donah )表示,该组织的民意调查显示,这项税收正在促使更多马萨诸塞州人重新考虑他们的居住地。

10 亿美元的税收法案会让马萨诸塞州更具竞争力吗?别指望它。

“在投票倡议之前,我们的成员说这将非常重要,”多纳说。“我认为我们收集的数据显示他们是对的。他们的客户在投票倡议之前说,‘看,如果州政府这样做,那对我来说就是最后一根稻草。’”

百万富翁税的支持者指出,到目前为止,这项附加税已经赚得盆满钵满,这证明富人不会大批离开,至少现在不会。税务部最近报告称,本财年前九个月,该州从税收中获得了 18 亿美元。这一令人惊讶的强劲数字使该州有望超过早先预测的全年 20 亿美元。

“我们没有确凿的证据表明离开的人数比以前更多,”服务业雇员国际工会马萨诸塞州委员会执行董事哈里斯·格鲁曼说。“我们迄今为止能够收集到的收入表明,这种情况并没有发生。如果说有什么不同的话,那就是百万富翁赚的钱比预期的要多。某种因素正在推高收入,而不是降低收入。”

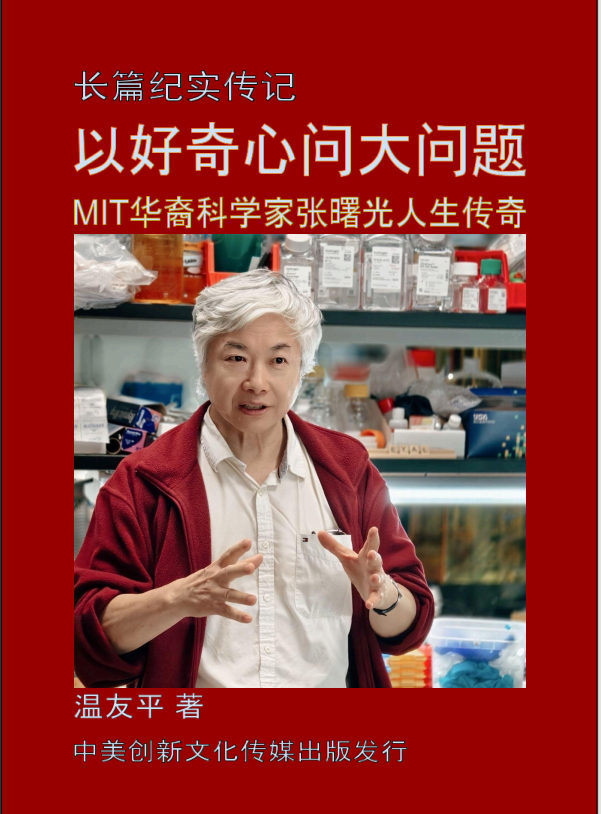

题图:马萨诸塞州注册会计师协会的一项新调查发现,三分之二的人表示,自 2022 年百万富翁税通过以来,至少有一位富有的客户已经搬离该州。DAVID L. RYAN/GLOBE STAFF

附原英文报道:

Are millionaires leaving Massachusetts? Survey (by their accountants) says yes.

The CPAs Society says many accountants are seeing high-earner clients departing the state since voters approved the ‘millionaires tax.’

By Jon Chesto Globe Staff,Updated June 21, 2024

A trade group for accountants is adding up the impact that the so-called millionaires tax is having on the state’s economy. The early returns — at least from their perspective — aren’t pretty.

The Massachusetts Society of Certified Public Accountants released survey results this week that show two-thirds of their members reported at least one client who had moved away from Massachusetts last year, the first year that the income tax surcharge on high earners was in effect. Ninety percent said they have other clients who are considering leaving the state within the next year. Nearly all reported that the millionaires tax factored into their clients’ decisions to consider leaving, with one-third indicating it was the primary reason. And more than half said the clients most at risk of leaving are between 30 and 60 years old.

Ever since Massachusetts voters approved the millionaires tax in November 2022, business groups like MassCPAs have been sharing anecdotes about how it’s prompting wealthy residents to head for the exit, usually to income-tax-free states such as New Hampshire or Florida. But actual data has been sparse, and tax collections from the surcharge so far have exceeded state projections.

The surcharge adds another 4 percentage points to the state’s 5 percent income tax for annual earnings over $1 million, with proceeds directed to transportation and education. Advocates, led by the teachers union-backed coalition Raise Up Massachusetts, argue that the economic benefits from spending on those causes more than offset any negative impact.

So far, hard data has been hard to come by; the most recent publicly available IRS figures on migration predate the millionaires tax vote. But Zach Donah, chief executive of MassCPAs, says his group’s poll shows the tax is prompting more Bay Staters to rethink where they live.

Will $1 billion tax bill make Mass. more competitive? Don’t count on it.

Business community has a big ask of new governor: Tackle taxes

“Leading up to the ballot initiative, our members were saying that this was going to be really significant,” Donah said. “I think our data that we’re collecting is showing they were right. Their clients were saying, going into the ballot initiative, ‘Look, if the state does this, it’s going to be the final straw for me.’”

Supporters of the millionaires tax point to the money the surcharge has raked in so far as evidence that wealthy people aren’t leaving in droves, at least not just yet. The Department of Revenue recently reported that the state received $1.8 billion in the first nine months of this fiscal year from the tax. That surprisingly strong amount puts the state on pace to exceed earlier forecasts of up to $2 billion for a full year.

“We have no concrete evidence of people leaving in bigger numbers than they did before,” said Harris Gruman, executive director for the SEIU’s Massachusetts council. “The revenue we have been able to collect to date suggests there’s no such thing happening. If anything, millionaires are making more money [than expected]. Something is driving up the revenues, rather than driving them down.”