【中美创新时报2024年3月15日讯】(记者温友平编译)TikTok 的时间可能已经不多了。这款中国拥有的应用程序可以让零售商接触到难以捉摸的 Z 世代消费者,这是其他应用程序无法比拟的。TikTok 在美国的日子可能已经过去了,但零售商们——他们可能会损失惨重——却对这款流行社交媒体应用的命运保持沉默。《波士顿环球报》记者托马斯·李(Thomas Lee)对此进行了如下报道。

众议院周三通过了一项得到拜登总统支持的法案,该法案可能会在该国有效禁止 TikTok,除非其中国所有者字节跳动出售该业务。禁令对零售商来说可能是灾难性的,因为 TikTok 已成为吸引难以捉摸的 Z 世代消费者的关键方式,尤其是在时尚和美容等趋势驱动的类别中。

“TikTok 吸引了很多眼球,”塔吉特前创新高管吉恩·汉 (Gene Han) 表示,他现在为初创企业提供咨询服务。

然而,在投票前夕,零售商几乎没有公开谈论 TikTok 在国会面临的困境。一个可能的原因是,零售商希望远离美国和中国之间贯穿此类辩论的复杂竞争。

该行业领先的贸易协会全国零售联合会发言人丹妮尔·英曼(Danielle Inman)在一封电子邮件中表示,“目前正在审查拟议的立法,目前尚未发布正式立场”。

零售业领袖协会发言人没有回应置评请求。弗雷明汉的 TJX Companies Inc. 拒绝置评。该零售商经营 T.J. Maxx 和 Marshalls 已被证明深受 Z 世代购物者的欢迎,部分原因是 TikTok 用户推荐了该公司的服装。

专家表示,零售商可能对潜在禁令保持沉默,但不可否认 TikTok 对行业的重要性。自2017年进入美国以来,TikTok已积累了约1.5亿月活跃用户。根据消费者和市场数据提供商 data.ai 的博客文章,去年,它为全球消费者带来了 100 亿美元的支出,成为首个实现这一目标的非游戏移动应用。

在用户方面,TikTok仍远远落后于社交媒体平台Facebook(30.5亿月活跃用户)、YouTube(24.9亿)、Instagram(14亿)和Pinterest(5亿)。

然而,一些数据显示,在商业影响方面,TikTok 的势头正在增强。

软件公司 Capterra 去年的一项调查显示,77% 的中小型零售商和餐馆表示,TikTok 带来的销售额在过去 12 个月中有所增加,其中 23% 的人表示增幅显着。

此外,其中 71% 的公司表示今年将增加 TikTok 营销支出,而 37% 的公司将减少在 Facebook 上的支出,32% 的公司将减少在 Instagram 上的支出。

TikTok 特别有价值的是它在年轻消费者中的受欢迎程度。该应用程序以其主题广泛的短视频而闻名,但经常有社交媒体影响者推荐热门产品和服务。

“TikTok 处于内容和媒体的融合点,”西雅图 Halo Advisory Services 创始人 Han 表示。他说,这些短视频特别吸引年轻消费者,他们更喜欢观看更快、更吸引人、更真实的内容。

对于梅西百货、Gap 和 J. Crew 等美国服装连锁店来说,吸引年轻人一直是一个特殊的挑战。这些曾经在时尚界占据主导地位的美国零售商,已经被外国快时尚连锁店瑞典H&M、西班牙Zara、日本优衣库以及准备赴美上市的中国Shein等外国快时尚连锁店夺走了相当大的市场份额。这些连锁店在 TikTok 内容上投入巨资并非偶然。

但 TikTok 让一些美国零售商能够与 Z 世代购物者保持联系。去年,TJX 在名为“Bama Rush”的 TikTok 现象中走红,阿拉巴马大学和许多其他学校的联谊会女孩们发布了她们 Rush Week 服装的照片,其中许多是在 T.J. 购买的。

TJX 首席执行官艾琳·赫尔曼 (Erine Herrman) 告诉分析师:“我们吸引了不成比例的新(年轻)购物者,这才是我们真正关注的未来增长,因为这意味着未来更高的支出。”

但 TikTok 可能会为零售业提供比简洁视频更有价值的东西:将所有这些点击转化为付费客户的机会。2022年,该应用推出了TikTok Shop,用户无需离开应用即可购买品牌商品。

多年来,Facebook、Instagram、Pinterest 和 X(以前称为 Twitter)一直在尝试社交商务:将其庞大的受众转化为付费客户。虽然消费者使用社交媒体来研究产品,但他们更不愿意在这些网站上实际购买商品。

分析师表示,TikTok 可能会成为将社交商务从理论转变为现实的平台。

Coresight Research 高级分析师 Sunny Cheng 表示:“TikTok 有潜力成为游戏规则的改变者。” 但她表示,TikTok Shop 仍需要改进,该网站还需要两到三年才能产生有意义的销售。

TikTok 在美国的未来仍然不明朗。国会中的共和党人和民主党人批评了该应用程序,因为其所有者字节跳动是一家与执政的共产党有联系的中国公司。他们担心中国政府可能会获取 TikTok 收集的大量用户数据,并可能将其武器化。

众议院以压倒性多数通过的两党法案将迫使字节跳动出售 TikTok。然而,中国政府已经表示不会允许此类出售。在这种情况下,法律将禁止应用商店搭载 TikTok,这将阻止当前用户接收所需的更新。

Coresight 的郑认为事情不会发展到这个地步。她表示,最终,TikTok 和国会将达成妥协,进一步保护用户数据。该法案目前已提交参议院,其未来尚不确定。

但郑说,有一点是肯定的。

她说,TikTok 的影响力已经变得如此之大,以至于“品牌和零售商需要以某种方式参与 TikTok,特别是如果他们针对的是年轻消费者。”

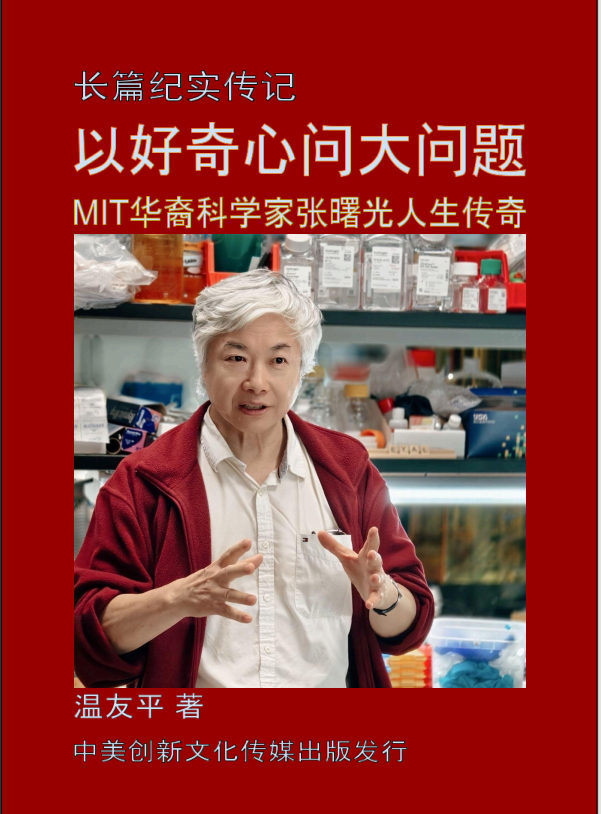

题图:《波士顿环球报》视频专题报道截屏。

附原文英文报道:

T.J. Maxx and other retailers really need TikTok. They have remained silent on a possible ban.

The Chinese-owned app allows retailers to reach elusive Gen Z consumers, something other apps can’t match

By Thomas Lee Globe Staff,Updated March 14, 2024

The clock could be ticking for TikTok

The clock may be ticking on TikTok in the United States but retailers — who have a lot to lose — have been mum on the popular social media app’s fate.

The House of Representatives on Wednesday passed a bill, supported by President Biden, that could effectively ban TikTok in the country unless ByteDance, its Chinese owner, sells the business. A ban could be disastrous for retailers, since TikTok has become a key way of reaching elusive Gen Z consumers, especially in trend-driven categories like fashion and beauty.

“TikTok drives a lot of eyeballs,” said Gene Han, a former top innovation executive at Target who now advises startups.

And yet in the lead-up to the vote, retailers said little to nothing publicly about TikTok’s predicament in Congress. One possible reason is that retailers want to stay clear of the complicated rivalry between the United States and China that permeates such debates.

The National Retail Federation, the industry’s leading trade association, is “currently reviewing the proposed legislation and has not issued a formal position at this time,” spokesperson Danielle Inman said in an email.

A spokesperson for the Retail Industry Leaders Association did not respond to a request for comment. And TJX Companies Inc. in Framingham declined to comment. The retailer, which operates T.J. Maxx and Marshalls, has proven popular with Gen Z shoppers, thanks in part to TikTok users featuring its clothes.

Retailers may be silent on the potential ban, but there’s no denying TikTok’s importance to the industry, experts say. Since entering the United States in 2017, TikTok has amassed about 150 million monthly active users. Last year, it generated $10 billion in global consumer spending, becoming the first non-game mobile app to do so, according to a blog post by consumer and market data provider data.ai.

In terms of users, TikTok still trails far behind social media platforms Facebook (3.05 billion monthly active users), YouTube (2.49 billion), Instagram (1.4 billion), and Pinterest (500 million).

Yet when it comes to business impact, TikTok is gaining steam, some data suggest.

A survey last year by software firm Capterra said 77 percent of small- and medium-sized retailers and restaurants said sales attributable to TikTok have increased in the previous 12 months, with 23 percent reporting a significant increase.

Moreover, 71 percent of those companies said they will increase their TikTok marketing spend this year, while 37 percent will spend less on Facebook and 32 percent will spend less on Instagram.

What makes TikTok particularly valuable is its popularity among younger consumers. The app is especially known for its short videos on a wide range of topics but often features social media influencers recommending hot products and services.

“TikTok sits at the convergence of content and media,” said Han, founder of Halo Advisory Services in Seattle. The short videos especially appeal to younger consumers who prefer to watch faster content that’s still compelling and authentic, he said.

Reaching younger people has been a special challenge to US apparel chains such as Macy’s, Gap, and J. Crew. These American retailers, which once dominated the fashion scene, have lost significant market share to foreign fast fashion chains H&M in Sweden, Zara in Spain, Uniqlo in Japan, and Shein in China, which is preparing to go public in the United States. It’s no accident that the chains have invested heavily in TikTok content.

But TikTok has allowed some American retailers to stay relevant with Gen Z shoppers. Last year, TJX trended in the TikTok phenomenon known as Bama Rush, in which aspiring sorority girls at the University of Alabama — and many other schools — posted pictures of their Rush Week outfits, many bought at T.J. Maxx.

“We have been attracting a disproportionate number of new (younger) shoppers, which is what we really look at in terms of future growth because that’s the future higher spend,” TJX chief executive Erine Herrman told analysts.

But TikTok may offer the retail industry something even more valuable than pithy videos: an opportunity to convert all of those clicks into paying customers. In 2022, the app launched TikTok Shop, which allows users to purchase brands’ merchandise without leaving the app.

For years, Facebook, Instagram, Pinterest, and X (formerly Twitter) have been experimenting with social commerce: converting their enormous audiences into paying customers. While consumers use social media to research products, they have been more reluctant to actually buy items on these sites.

Analysts say TikTok could emerge as the platform that transforms social commerce from theory to reality.

“TikTok has the potential to be a game changer,” said Sunny Zheng, a senior analyst with Coresight Research. But TikTok Shop still needs improvements and it would take another two to three years for the site to generate meaningful sales, she said.

TikTok’s future in the United States remains cloudy. Republicans and Democrats in Congress have criticized the app because ByteDance, its owner, is a Chinese firm with ties to the ruling Communist Party. They fear the Chinese government could access, and potentially weaponize, the huge volume of data TikTok collects on its users.

The bipartisan bill the House overwhelmingly approved would force ByteDance to sell TikTok. However, the Chinese government has already said it would not allow such a sale. In that case, the law would ban app stores from carrying TikTok, which would prevent current users from receiving needed updates.

Zheng of Coresight doesn’t think it will come to that. Eventually, TikTok and Congress will reach a compromise that will further safeguard user data, she said. The bill now heads to the Senate, where its future is uncertain.

But one thing is for sure, Zheng said.

TikTok has grown so influential, she said, that “brands and retailers need to be on TikTok in some capacity, particularly if they target younger consumers.”