【中美创新时报2024 年 12 月 3 日编译讯】(记者温友平编译)首批通过马萨诸塞州 MBTA 社区计划的城镇之一莱克星顿(Lexington)这座历史富裕名镇现在正在看到成果。《波士顿环球报》记者Andrew Brinker对此作了下述报道。

在莱克星顿的贝德福德街上,大型独户住宅和双户住宅点缀着被绿树环绕的街景,该社区的最新成员是一个建筑区。

很快,这片如今堆满了建筑设备和正在打地基的工人的土地将容纳 30 套新公寓。

这是波士顿郊区随处可见的中型多户住宅。但这一项目不同寻常之处在于它如此轻松地通过了镇政府的批准。与该镇周边的同类新开发项目不同,它不需要莱克星顿分区委员会的特别许可,而是莱克星顿去年通过的新分区规则下八个新项目之一,该规则旨在简化公寓和共管公寓的建设。

这些规则是受该州 MBTA 社区法的推动,当 2023 年 4 月市政会议投票批准这些规则时,莱克星顿成为第一个通过分区以遵守法律的城镇。在这个富裕的西北郊区,根据这些新规则,将有近 1,000 套新公寓和共管公寓即将建成。可能还会有更多项目即将建成,这或许是一个早期迹象,表明——至少在某些社区——法律正在按计划实施。

“这是一个相当快的发展过程,因此也存在一些挑战,”该镇规划总监 Abby McCabe 说。“但这是分区的运作方式,它本来就是如此。我们希望看到镇上有更多的住房,因为对住房的需求很大,现在我们得到了。”

如果所有这些单元最终都建成,它们将足以容纳这个拥有 35,000 人的小镇近 3,000 人,并且将代表莱克星顿自 1980 年代以来最大的多户住宅开发热潮。虽然大多数公寓都是市场价,但将有近 150 套公寓以可负担的租金出租,因为莱克星顿的新分区规则要求大多数新建建筑中 15% 的单元要为中低收入家庭定价。

这对州住房官员和州长 Maura Healey 的政府来说是一个充满希望的迹象,他们指望 MBTA 社区——要求 T 服务的城市和城镇让建造多户住宅变得更加容易——来刺激马萨诸塞州东部的大量住房生产。在莱克星顿,他们看到法律正在发挥他们希望的作用的证据。

今年早些时候,在与规划委员会和邻里举行了大约六个月的会议后,芬尼根开发公司和卡兹开发公司两家开发商批准了贝德福德街上的 30 套公寓项目。芬尼根开发公司的合伙人本·芬尼根说,许可流程严格而简单。

尽管该地产的建筑很复杂,比如开发商需要将一栋历史悠久的房屋搬到场地前面,但简化的许可流程(只要项目符合分区、环境、历史和法规参数,即可保证获得许可)大大缩短了时间。这与许多社区的建筑规则形成了鲜明对比,这些社区的建筑规则历来非常严格,以至于赶走了小型开发商。事实上,这正是芬尼根和他的合作伙伴一开始就被吸引的原因。

“这个项目是新分区的直接结果,”他说。“如果没有这个,我们不太可能考虑在这里建房。”

受益的不仅仅是像芬尼根这样的小型项目。该镇重新分区的一个主要特点是允许在利用率较低的办公园区和商业区建造多户住宅,其中一些在疫情后难以恢复。

一位开发商已提交计划,将 Militia Drive 上的低矮办公楼改造成一个拥有 319 个单元的混合用途开发项目,并配备一个六层停车场。办公巨头 Boston Properties 希望将 Hartwell Avenue 上的一栋单层生物技术办公楼改造成一座五层、312 个单元的公寓大楼,并配备一座独立的 2,100 平方英尺的零售大楼。而 Cabot、Cabot 和 Forbes 将把 Concord Avenue 上的一组地块重新开发成一座四层、200 个单元的公寓大楼。

自从 MBTA Communities 生效以来,Cabot 首席执行官 Jay Doherty 一直在该地区寻找潜在的开发地点。他说,莱克星顿的地点是他找到的最可行的地点。他上个月获得了规划委员会的批准。

“他们值得很多赞誉,”Doherty 说。“他们在这方面一直处于领先地位,他们看到了真正的成果。我希望那里能有 40 多个像莱克星顿这样的项目。”

镇政府官员并不惊讶在新的分区规则下出现了一些重大发展,尽管他们对如此迅速提出的许多计划感到措手不及。

一些观察人士表示,这表明该地区对新住房的需求有多么巨大,开发商很难找到可以建造的地方,而不会遭遇令人窒息的社区和镇政府的反对。

这就是为什么州政府官员对 MBTA 社区寄予厚望,该法案于 2021 年通过,并明确要求各镇在马萨诸塞州东部为数以万计的新单元腾出空间。

到目前为止,回报喜忧参半。

截至上个月,已有 100 多个社区通过了 MBTA 社区计划。一些社区,例如列克星敦,相当于重大的重新分区,可能会解锁大量新住房并帮助振兴重要社区。但有些城镇仍然处于完全抵制该法律的状态,对州政府强制改变其长期存在的分区规则感到不满,或者根本不希望增加新住房。其他城镇制定了分区规则,这些规则在技术上符合规定,但实际上却很少允许新建住房。

事实上,莱克星顿是个例外。到目前为止,全州至少有 2,800 套住房正在根据该法律建设,其中约有 1,000 套在莱克星顿。但在一个传统上发展不多的城镇,发展势头强劲,至少表明该法律可以在有意使用该法律的社区中产生大量新住房。

莱克星顿是引领这一趋势的城镇,这也具有象征意义,其家庭收入中位数超过 20 万美元,单户住宅价格约为 160 万美元。在这个地方,分区规则长期以来一直被用来阻止新开发,这使得该镇随着时间的推移变得越来越排外。事实上,根据人口普查数据,直到最近,至少 12 年来这里从未建造过超过 5 个单元的建筑。

该镇近年来的研究显示,年轻和不太富裕的居民对公寓的需求不断增长。随着新的分区规则出台,城市领导人希望提供一些公寓,并在此过程中改变列克星敦的独家形象。

“我们对如此多的项目如此迅速地推出感到有点惊讶,”规划委员会成员罗伯特·彼得斯说。“但是……在过去的 25、30、40 年里,我们没有看到任何重建。在某种程度上,这是多年来积累的需求正在实现。”

彼得斯说,一些居民对新开发的速度感到担忧,或者对一些较大的项目有具体的担忧。但实际上,他说,新建筑只发生在该镇一小部分土地上。

“这些担忧是合理的,”彼得斯说。 “但莱克星顿有不少未得到充分利用且有待开发的地产。这是唾手可得的成果。”

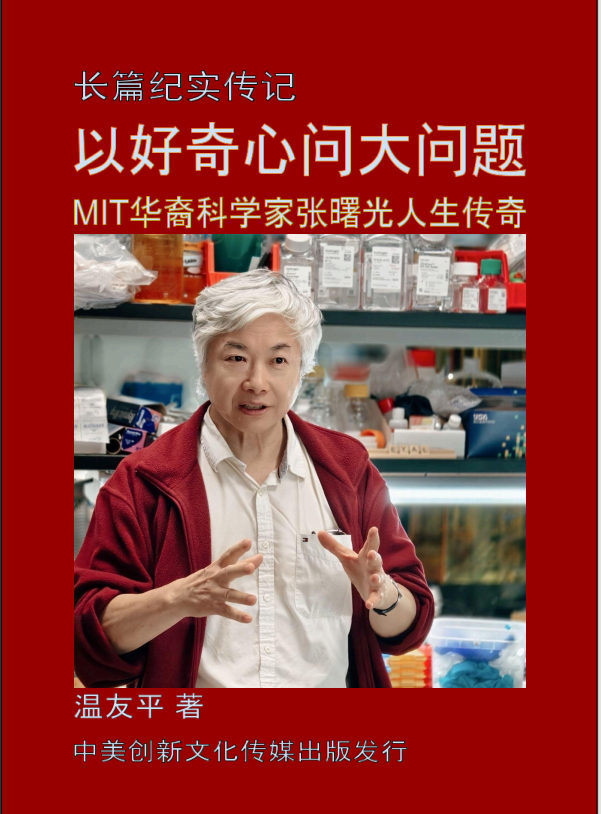

题图:莱克星顿贝德福德大道上正在建设一个 30 套公寓的开发项目。该开发项目是根据该镇的新分区规则允许的,该规则受到该州 MBTA 社区法的推动。Erin Clark/Globe 员工

附原英文报道:

In Lexington, the state’s housing law is on track to produce nearly 1,000 new homes

One of the first towns to pass an MBTA Communities plan is now seeing the results.

By Andrew Brinker Globe Staff,Updated December 3, 2024

A 30-unit condo development is under construction on Bedford Avenue in Lexington. The development was permitted under the town’s new zoning rules, spurred by the state’s MBTA Communities law.Erin Clark/Globe Staff

On Lexington’s Bedford Street, where big single- and two-family homes dot a streetscape framed by leafy trees, the newest addition to the neighborhood is a construction zone.

Soon, the parcel that these days is filled with construction equipment and workers laying a foundation will hold 30 new condos.

It’s the kind of mid-sized multifamily property that dots the Boston suburbs. But what makes this one unusual is how easily it sailed through town approvals. Unlike new development of its kind around the town, it didn’t need special permission from Lexington’s zoning board, rather, it’s one of eight new projects so far in the pipeline under new zoning rules that Lexington passed last year to make it easier to build apartments and condos.

Those rules were spurred by the state’s MBTA Communities law, and made Lexington the first town to pass zoning to comply with the law when Town Meeting voted to approve them in April 2023. Nearly 1,000 new apartments and condos are in the pipeline to be built under those new rules in this affluent northwest suburb. And more could be on the way, perhaps an early sign that — at least in some communities — the law is working as planned.

“It is a lot of development fairly quickly, so there are some challenges associated with that,” said Abby McCabe, the town’s planning director. “But this is the zoning working how it was intended to work. We wanted to see more housing in town because there is a significant need for it, and now we’re getting it.”

If all of those units are eventually built, they would be enough to house nearly 3,000 more people in this town of 35,000, and would represent Lexington’s largest spurt of multifamily housing development since at least the 1980s. Although most of the apartments would be market-rate, nearly 150 will be set aside at affordable rents, because Lexington’s new zoning rules require 15 percent of the units in most new construction to be priced for lower- and middle-income families.

They represent a hopeful sign for state housing officials and Governor Maura Healey’s administration, who are banking on MBTA Communities — which requires cities and towns served by the T to make it easier to build multifamily housing — to spur significant housing production in Eastern Massachusetts. In Lexington, they see evidence that the law is working as they hoped it would.

The 30-unit project on Bedford Street was permitted earlier this year by a pair of developers, Finnegan Development and Katz Development Corp., after roughly six months of meetings with the Planning Board and abutters. The permitting process was robust but simple, said Ben Finnegan, a partner at Finnegan Development.

Despite construction complexities on the property, such as a historic house that the developers needed to move to the front of the site, the simplified permitting process — which guarantees permits so long as a project meets zoning, environmental, historical, and code parameters — shortened the timeline considerably. It is a sharp contrast from building rules in many communities that have historically been so arduous that they drive smaller developers away. Indeed, it’s what attracted Finnegan and his partners to begin with.

“This project is a direct result of the new zoning,” he said. “Without that, it’s unlikely we would have considered building here.”

It is not just smaller projects like Finnegan’s that have benefited. A major feature of the town’s rezoning was allowing multifamily housing at underutilized office parks and commercial areas, some of which are struggling for relevance post-pandemic.

One developer has filed plans to transform low-slung office buildings on Militia Drive into a 319-unit mixed-use development, with a six-level parking garage. Office giant Boston Properties wants to replace a single-story biotech office building on Hartwell Avenue with a 5-story, 312 unit apartment complex with a separate 2,100 square-foot retail building. And Cabot, Cabot, and Forbes will redevelop a group of parcels on Concord Avenue into a four-story, 200-unit apartment complex.

Cabot CEO Jay Doherty has been searching the region for potential development sites ever since MBTA Communities took effect. The Lexington site, he said, was the most viable one he has found. He won approval from the Planning Board last month.

“They deserve a lot of credit,” said Doherty. “They’ve been a leader on this, and they’re seeing real results. I wish there were 40 more Lexingtons out there.”

Town officials are not surprised they are seeing some major developments under the new zoning rules, though they have been caught off guard by how many have been proposed so quickly.

Some observers say it’s a sign of just how significant the demand for new housing is in the area, and how hard-pressed developers are to find places they can build on without encountering stifling neighborhood and town opposition.

That is why state officials have high hopes for MBTA Communities, which was passed in 2021 and set clear mandates for towns to make room for, cumulatively, tens of thousands of new units across Eastern Massachusetts.

So far, returns have been mixed.

As of last month, more than 100 communities have passed MBTA Communities plans. Some, such as Lexington, amount to major rezonings that could unlock significant new housing and help revitalize important neighborhoods. But some towns remain in a state of outright resistance to the law, unhappy that the state has mandated changes to their longstanding zoning rules, or with the prospect of adding new housing at all. Others have written zoning rules that technically comply but practically speaking enable little new housing.

Indeed, Lexington is an outlier. Of the at least 2,800 units statewide that are in the pipeline under the law so far, about 1,000 are in Lexington. But the big boost of development in a town that traditionally has seen little is at least one sign that the law can generate significant new housing in communities that use it intentionally.

It’s also symbolic that the town leading the way is Lexington, with its median household income topping $200,000 and a single-family home price of around $1.6 million. It’s the sort of place where zoning rules have long been used to block new development, which has made the town more and more exclusive over time. Indeed, until recently, it had been at least 12 years since a building with more than five units had been built there, according to Census data.

The town has done studies in recent years that revealed growing demand for apartments for younger and less affluent residents. With the new zoning rules, city leaders are hoping to provide some, and change Lexington’s exclusive image in the process.

“We’re a tad surprised at how many projects came off the shelf so quickly,” said Robert Peters, a member of the Planning Board. “But… we hadn’t seen any redevelopment over the last 25, 30, 40 years. In a way, this is the demand that built up over the years being realized.”

Some residents have been concerned by the pace of the new development broadly, or had specific concerns about a few of the bigger projects, said Peters. But really, he said, the new building is only happening on a tiny fraction of the town’s land.

“Those concerns are fair,” said Peters. “But Lexington has quite a few properties that are underutilized and ripe for development. This is the low-hanging fruit.”