【中美创新时报2024 年 11 月 13 日编译讯】(记者温友平编译)唐纳德·特朗普将批评高物价作为竞选口号,因为选民们正在努力应对 2022 年疫情后通胀飙升的持续影响。特朗普将以专家们一致认为健康的经济就任。所有关键数据点——尤其是通胀几乎恢复正常——都朝着正确的方向发展。《波士顿环球报》记者Jim Puzzanghera 对此作了下述报道。

比尔·克林顿以“这是经济问题,笨蛋”的竞选口号在 1992 年赢得了白宫,当时选民们正在努力应对经济衰退的挥之不去的影响,而经济衰退实际上已经结束了一年半多。

尽管选举日的经济数据指向正确的方向,但普通美国人尚未感受到它。乔治·H·W·布什总统受到指责并被选下台。随后,随着经济持续改善,克林顿获得了赞誉。

三十多年后,我们可能会在华盛顿重温似曾相识的往事。

唐纳德·特朗普将批评高物价作为竞选口号,因为选民们正在努力应对 2022 年疫情后通胀飙升的持续影响。特朗普将以专家们一致认为健康的经济就任。所有关键数据点——尤其是通胀几乎恢复正常——都朝着正确的方向发展。

但许多美国人尚未感受到自己财务状况的改善。尽管自 2023 年初以来,工资增长速度快于通胀,但经济学家表示,额外工资需要更多时间才能抵消这些更高的成本。

“从许多总体宏观经济指标来看,情况看起来相当不错,”密歇根大学广受关注的消费者信心调查首席经济学家 Joanne Hsu 表示。 “话虽如此,消费者并不觉得自己在蓬勃发展,而且他们对持续的高价格感到非常沮丧。”

选举日,在关键州的投票站民意调查中,约四分之三的选民表示,过去一年通货膨胀给他们或他们的家庭带来了困难。金融信息公司 Bankrate 的一项研究发现,物价和工资增长之间的差距正在缩小,但尚未消除。从 2021 年初到今年 6 月底,物价上涨了 20%,而工资上涨了 17.4%。

“美国经济的表现出人意料地强劲和富有弹性,”Bankrate 高级经济分析师马克·哈姆里克说。“矛盾之处在于,人们试图将经济状况归因于他们认为个人财务状况应该如何,但很明显他们并不总是一致的。”

特朗普承诺要降低物价。但除了汽油外,大多数其他商品(如食品杂货)的价格很少下降。因此,工资增长需要继续超过通货膨胀率 6 到 12 个月,人们在这些物品上花费的收入百分比才能恢复到 2022 年价格飙升之前的水平。

“经济表现异常良好,但没有人相信这一点,而且在一段时间内他们也不会相信,直到支付这些高价的痛苦消失。它会消失。它已经消失了,”经济和研究咨询公司穆迪分析的首席经济学家马克·赞迪说。

“有点讽刺的是,也许特朗普总统会在这里获得赞誉,因为如果一切都按剧本进行,经济保持相当好的势头,12 个月后人们会感觉好很多,”他继续说。“这根本与特朗普总统无关。”

但这条路并不是一成不变的。经济学家担心特朗普的一些政策可能会导致通胀再次飙升。

他计划延长 2017 年的全面减税政策,甚至可能扩大减税范围,这可能会使经济过热并推高物价——尤其是如果他试图阻止美联储提高利率来应对这种情况的话。他大规模驱逐无证移民的誓言将使经济中的工人流失,如果雇主不得不进一步提高工资以吸引美国公民从事这些工作,则可能导致物价上涨。

特朗普承诺提高进口产品的关税——美国进口商支付的费用——可能会导致这些商品在美国的价格上涨。

汽车零部件零售商 AutoZone 的首席执行官 Phil Daniele 在 9 月告诉投资者:“如果我们征收关税,我们将把这些关税成本转嫁给消费者。”“我们通常会在知道关税是多少之前提高价格。”

在最近的季度调查中,一个由美国企业和行业贸易协会的经济学家组成的组织发现,关税成本高于预期是经济面临的最大下行风险之一。但总体而言,美国全国商业经济协会的调查发现,经济衰退的风险正在下降,通胀担忧正在减弱。

“目前,经济看起来非常非常稳健,”房地产数据分析公司 CoreLogic 首席经济学家兼调查主席塞尔玛·赫普 (Selma Hepp) 表示。“一切都在朝着正确的方向发展。”

在这一点上,人们达成了广泛的共识。

上个月,国际货币基金组织将今年美国经济增长预测上调至 2.8%,而所有发达经济体的平均增长率为 1.8%。它预测美国明年的经济增长率为 2.2%,高于七国集团任何一个主要工业化经济体的增长率。在选举前几天,《华尔街日报》刊登了一篇题为《下一任总统继承了一个非凡的经济》的文章。

就业增长有所放缓但仍保持稳健,经济学家一致认为,10 月份新增就业岗位仅 1.2 万个,这是飓风和劳工罢工造成的异常现象。汽油价格正在下跌,通胀率从 2022 年中期 40 年来的最高水平 9.1% 下降至接近美联储 2% 的目标。

美联储大幅加息有助于降低通胀,现在央行也在降低这些利率,这将降低个人和商业贷款的成本。

美联储主席杰罗姆·鲍威尔上周对记者表示:“美国经济表现如此出色,增长强劲,劳动力市场强劲,通胀下降,这确实令人惊叹。我们的表现确实比全球任何同行都要好。”

但鲍威尔承认民意调查和总统大选结果都表明了这一点。

“我们说经济表现良好,事实也确实如此,但我们也知道人们仍在感受到高价格的影响…… “通胀会一直伴随着你,因为物价水平不会回落,”他说。“人们需要几年的实际工资增长才能感觉好些。而这正是我们试图创造的。”

全球预测和分析公司牛津经济研究院的首席美国经济学家瑞安·斯威特 (Ryan Sweet) 也认为,美国人对自己的财务状况和经济状况的感觉好些还需要一段时间。

“用经济学家的话来说,通胀的魔咒又回到了瓶子里……但这并没有引起普通美国人的共鸣,”他说。“他们知道,面包、鸡蛋的价格、房租的价格仍然明显高于去年同期、四年前、八年前,这就是他们关注的重点。”

短期内通胀和经济的任何变化都是特朗普上任后趋势的延伸。

“总统继承经济,”斯威特说。“他们不一定会在第一天或头 100 天重塑经济。”

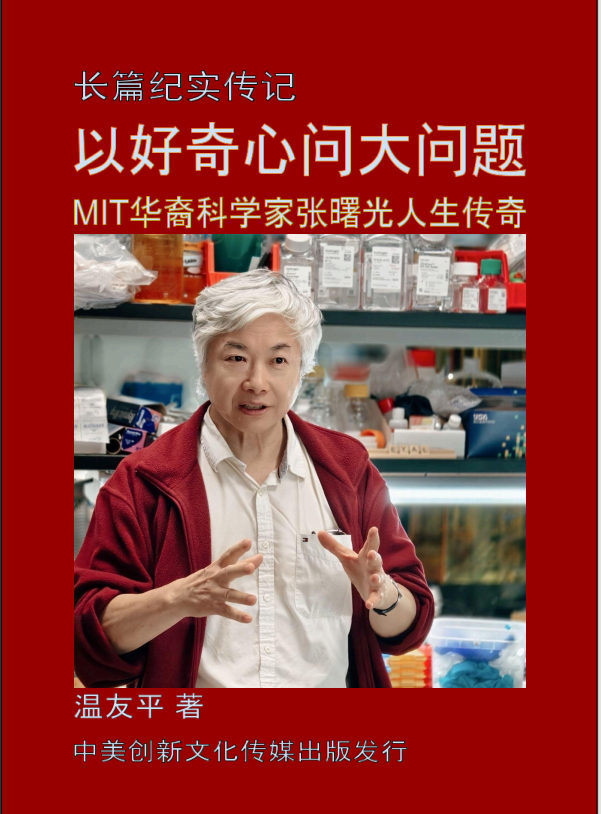

题图:唐纳德·特朗普在竞选访问宾夕法尼亚州基坦宁的 Sprankle’s 社区市场时强调了通货膨胀对食品价格的影响。Win McNamee/Getty

附原英文报道:

Trump inherits a healthy economy, experts agree, and he could get credit when Americans eventually feel better

By Jim Puzzanghera Globe Staff,Updated November 13, 2024

Donald Trump highlighted inflation’s effects on grocery prices in a campaign visit to Sprankle’s Neighborhood Market in Kittanning, Pa..

Donald Trump highlighted inflation’s effects on grocery prices in a campaign visit to Sprankle’s Neighborhood Market in Kittanning, Pa..Win McNamee/Getty

WASHINGTON — With a campaign mantra of “it’s the economy, stupid,” Bill Clinton won the White House in 1992 as voters struggled with the lingering effects of a recession that technically had ended more than a year and a half earlier.

Although the economic data was pointing in the right direction on Election Day, average Americans had yet to feel it. President George H.W. Bush got the blame and was voted out of office. Then, as the economic improvements continued to kick in, Clinton got the credit.

More than three decades later, we could be headed for deja vu in Washington.

Donald Trump, who made criticizing high prices a campaign mantra as voters struggle with the lingering effects of 2022′s post-pandemic inflation spike, is set to take office with an economy that experts agree is healthy. All the key data points ― notably inflation, which is nearly back down to normal — are trending in the right direction.

But many Americans have yet to feel the improvements in their own finances. Although wages have grown faster than inflation since early 2023, economists said it’s going to take more time for that extra pay to offset those higher costs.

“On a lot of aggregate macroeconomic indicators, things look pretty good,” said Joanne Hsu, chief economist for the University of Michigan’s widely followed consumer confidence survey. “That being said, consumers don’t feel like they’re thriving at all, and they remain extremely frustrated by the persistence of high prices.”

About three-quarters of voters in exit polls in key states on Election Day said inflation had been a hardship for them or their family over the past year. And a study by financial information firm Bankrate found that the gap between growth in prices and wages is narrowing but not yet closed. From the start of 2021 through the end of this past June, prices increased 20 percent while wages rose 17.4 percent.

“The performance of the US economy has been surprisingly robust and resilient,” said Mark Hamrick, Bankrate’s senior economic analyst. “The contradiction is where people try to ascribe the state of the economy to how they think an individual’s personal finances ought to be and it’s clear they aren’t always aligned.”

Trump has promised to bring prices down. But aside from gasoline, prices for most other purchases, such as groceries, rarely drop. So wage growth needs to continue to outpace inflation for another six to 12 months before the percentage of the income that people spend on those items returns to what it was before prices shot up in 2022.

“The economy is performing exceptionally well, but nobody believes it, and they’re not going to for a while, until [the pain of] having to pay those higher prices fades away. And it will fade. It’s fading already,” said Mark Zandi, chief economist at economics and research consulting firm Moody’s Analytics.

“Kind of the dark irony is maybe President Trump’s going to get the credit here because, if everything sticks to script and the economy hangs reasonably well together, 12 months from now people are going to feel a lot better,” he continued. “And this simply had nothing to do with President Trump.”

But that path is not set in stone. And economists worry that some of Trump’s policies could cause inflation to jump again.

His plan to extend the sweeping 2017 tax cuts, and possibly expand them, could overheat the economy and drive up prices — especially if he tries to keep the Federal Reserve from raising interest rates to counter it. His vow for mass deportation of undocumented immigrants would drain workers from the economy and could cause prices to rise if employers have to boost wages even higher to attract US citizens to take those jobs.

And Trump’s promise to hike tariffs on imported products — fees that US importers pay — could lead to higher prices here for those goods.

“If we get tariffs, we will pass those tariff costs back to the consumer,” Phil Daniele, chief executive of auto parts retailer AutoZone, told investors in September. “We’ll generally raise prices ahead of [when] we know what the tariffs will be.”

In its most recent quarterly survey, an organization of economists for US businesses and industry trade associations found that higher-than-expected costs from tariffs was one of the top downside risks to the economy. But broadly, the National Association for Business Economics survey found the risk of recession was falling and concerns about inflation were abating.

“The economy looks really, really solid at the moment,” said Selma Hepp, chief economist at real estate data analytics firm CoreLogic and chair of the survey. “Everything is moving in the right direction.”

There’s broad consensus on that point.

Last month, the International Monetary Fund upgraded its projection for US economic growth this year to 2.8 percent compared with an average of 1.8 percent for all advanced economies. Its forecast of 2.2 percent US growth next year is higher than that of any of the Group of Seven leading industrialized economies. In the days before the election, the Wall Street Journal ran a story headlined, The Next President Inherits a Remarkable Economy.

Job growth has eased but remains solid, with economists agreeing that October’s meager gain of 12,000 new jobs was an anomaly caused by hurricanes and labor strikes. The price of gas is falling and inflation is down from a four-decade high of 9.1 percent in mid 2022 to close to the Federal Reserve’s target of 2 percent.

Aggressive Fed interest rate hikes helped reduce inflation, and now the central bank is lowering those rates as well, which will make personal and business loans less expensive.

“It’s actually remarkable how well the US economy has been performing with strong growth, a strong labor market, inflation coming down,” Federal Reserve Chair Jerome Powell told reporters last week. “We’re really performing better than any of our global peers.”

But Powell acknowledged what polls and the results of the presidential election have shown.

“We say that the economy is performing well, and it is, but we also know that people are still feeling the effects of high prices. . . . It stays with you because the price level doesn’t come back down,” he said. “It takes some years of real wage gains for people to feel better. And that’s what we’re trying to create.”

Ryan Sweet, chief US economist at Oxford Economics, a global forecasting and analysis firm, agreed it’s still going to be a while before Americans feel better about their own finances and the economy.

“In economist-speak, the inflation genie’s back in the bottle. . . . But that doesn’t resonate with the average Americans,” he said. “They know that the prices of bread, eggs, the price of their rent, is still noticeably higher than it was this time last year, four years ago, eight years ago, and that’s what they’re focused on.”

And whatever happens with inflation and the economy in the shorter run is an extension of the trends greeting Trump as he takes office.

“Presidents inherit economies,” Sweet said. “They don’t necessarily reshape them on day one or in the first 100 days.”