美国经纪人新佣金规则使买卖房屋变得更加复杂

【中美创新时报2024 年 8 月 26 日编译讯】(记者温友平编译)随着美国房地产经纪人新规则的实施,支持者表示,这些变化将降低卖家的成本,从而导致房价下跌。但是,事实上不那么肯定。《波士顿环球报》专栏作家拉里·埃德尔曼(Larry Edelman)对此作了下述详细分析报道。

我们进入了一些人所说的买卖房屋的新时代。它最终可能会看起来很像旧时代——至少在一段时间内。

新闻:新规则于 8 月 17 日生效,规定了房地产经纪人如何获得报酬。

几十年来,卖方支付佣金(通常是销售价格的 5-6%),然后他们的经纪人与买方经纪人平分佣金(通常是 50/50),这种惯例已经一去不复返了。

现在,买家必须签署一份合同,列出佣金和其他条款。他们可能同意支付一定比例或固定费用,以支付过去几乎总是由卖方支付的服务,尽管这并非一成不变。

卖家应该有更大的灵活性来协商较低的佣金,因为他们的经纪人不再自动分享他们的费用。

了解详情:这些变化源于今年早些时候全国房地产经纪人协会与购房者达成的和解,该协会指控经纪人佣金规则等同于操纵价格。

购房者的律师辩称,将交易双方经纪人的佣金“脱钩”——根据牛津经济研究院和 Haver Analytics 的数据,这一金额每年超过 1000 亿美元——可以通过让卖家和买家更容易谈判来降低成本。

诉讼还称,NAR 规则激励经纪人将寻找房屋的客户引向更昂贵的房产,以赚取更多佣金。

但是:这项协议让经纪人和消费者不得不讨论新的佣金模式——或者更可能是一系列选择。这个过程可能需要数月甚至数年的时间,同时使买卖双方的事情变得复杂。

“新规则为消费者提供了机遇和风险,”美国消费者联合会高级研究员斯蒂芬·布罗贝克说。

从好的方面来看,他说,更频繁的谈判可能会压低佣金率。房价最终也可能走低,因为卖家经常将佣金计入要价。

从坏的方面来看,布罗贝克担心经纪人会想方设法维持现状。一种情况是:买方经纪人可能会威胁不带人看房,而卖方经纪人不愿意分摊佣金。

不满意的经纪人:NAR 拥有 100 多万会员,许多人担心这些规定意味着减薪,尤其是为潜在买家工作的经纪人。

“这将对真正需要代理但又负担不起的买家产生负面影响,”剑桥经纪人、大波士顿房地产经纪人协会前任主席 Dino Confalone 说。对于首次购房者来说尤其如此,他们已经面临着高昂的价格和高抵押贷款利率。

变通办法:根据法院协议,NAR 表示将从其附属机构(称为多重上市服务或 MLS)在全国范围内运营的房地产上市数据库中删除佣金分成条款。

但经纪人仍然可以同意在这些数据库之外分割佣金。他们可以通过短信或电子邮件简单地做到这一点。购买要约或销售合同可以明确说明部分佣金将归买方经纪人所有。

“大多数行业都朝着要约包括补偿条款的方向发展,”马萨诸塞州房地产经纪人协会首席执行官 Theresa Hatton 说。 “这种情况可能一直存在,但现在可能更频繁地发生。”

CFA 的 Brobeck 认为,履行和解协议精神和文字的最简单方法是将买家及其代理人商定的任何佣金转入抵押贷款。这将允许买家分期付款,而不是像现在这样在交易结束时付款。

然而,房利美、房地美和联邦住房管理局(购买或担保大多数抵押贷款的政府实体)将不得不修改其规则,这些规则目前使展期变得困难。

“我乐观地认为,目前的和解协议造成了如此多的混乱和冲突,以至于一年内这种融资将成为可能,”Brobeck 表示,他相信佣金将随着时间的推移而下降。

其他选择:买家可以要求卖家支付部分或全部经纪人佣金,就像他们现在有时支付交易费用一样。如果买家的出价不错,卖家可能会同意。

或者买家可以同意支付他们的经纪人代表他们。如果他们这样做,Brobeck 建议收取固定费用,因为基于购买价格的佣金可能会鼓励经纪人推销更昂贵的房屋。

最后的想法:颠覆 NAR 的佣金模式(可追溯到 1913 年)将在短期内造成破坏。从长远来看,和解可能不会带来太大的变化。

这也许不是那么糟糕。

“人们错失机会只是因为他们不准备自己提出报价,”米尔顿 Coldwell Banker 的经纪人 Kim Powers 说。“对佣金的关注让买家被搁置一边。”

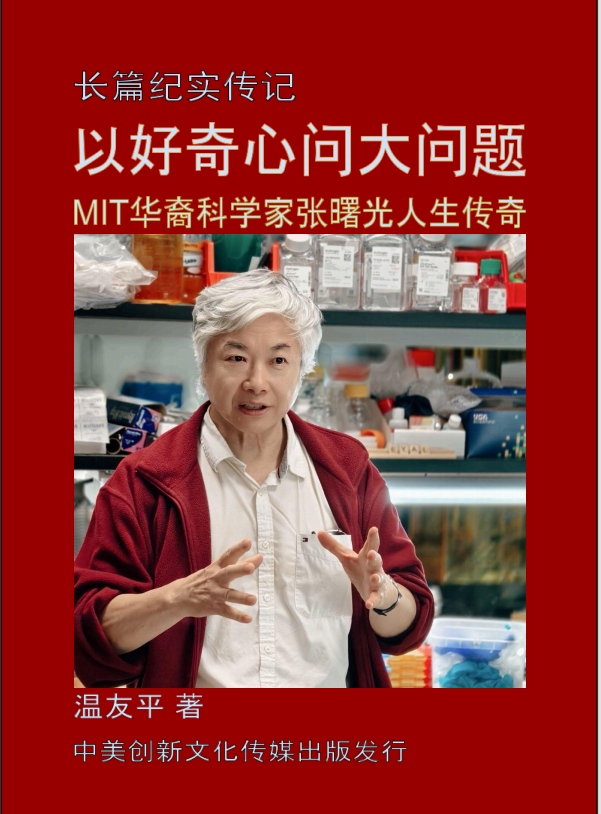

题图:“人们只是因为不准备自己提出报价而错失机会,”米尔顿 Coldwell Banker 的经纪人 Kim Powers 说。Debee Tlumacki

附原英文报道:

Buying and selling homes just got more complicated. Here’s what to know about new commission rules for agents.

Proponents say the changes will lower costs for sellers, leading to a decline in home prices. Don’t be so sure.

By Larry Edelman Globe Columnist,Updated August 26, 2024

We’ve entered what some are calling a new era for buying and selling homes. It may end up looking a lot like the old era — at least for a while.

The news: New rules took effect on Aug. 17 governing how real estate agents can be compensated.

Gone is the decades-old convention in which sellers paid a commission — usually 5–6 percent of the sales price — and their agent would split the money, typically 50/50, with the buyer’s broker.

Instead, buyers will now be required to sign a contract setting out the commission and other terms. They might agree to pay a percentage or a flat fee for services that sellers almost always covered in the past, though this isn’t set in stone.

And sellers should have more flexibility to negotiate a lower commission, since their agent is no longer automatically sharing their fee.

Catch up: The changes stem from the National Association of Realtors’ settlement earlier this year of lawsuits by home buyers alleging that agent commission rules were tantamount to price fixing.

Lawyers for the home buyers argued that “decoupling” commissions for agents on either side of the deal — an amount that exceeds $100 billion a year, according to Oxford Economics and Haver Analytics — could reduce costs for sellers and buyers by making it easier for them to negotiate.

The lawsuits also said the NAR rules gave brokers the incentive to steer their house-hunting clients to more expensive properties to earn bigger commissions.

But: The deal has left agents and consumers to hash out a new commission model — or, more likely, an array of options. The process could take months, if not years, and complicate things for buyers and sellers in the meantime.

“The new rules provide both opportunities and risks for consumers,” said Stephen Brobeck, a senior fellow at the Consumer Federation of America.

On the plus side, he said, more frequent negotiation may push commission rates down. Home prices could eventually trend lower, too, because sellers frequently bake the commission into their asking price.

On the negative side, Brobeck fears that agents will find ways to preserve the status quo. One scenario: A buyer’s agent might threaten to not show a home where the seller’s agent isn’t willing to split the commission.

Unhappy agents: The NAR has more than 1 million members, and many are worried that the rules mean a pay cut, especially for agents working for prospective buyers.

“It will have a negative effect on buyers that truly need representation but won’t be able to afford it,” said Dino Confalone, a Cambridge agent and past president of the Greater Boston Association of Realtors. That’s especially true of first-time buyers, who are already facing steep prices and high mortgage rates.

Work-arounds: Under the court agreement, the NAR said it would remove commission-sharing terms from the property listing databases run by its affiliates — known as multiple listing services, or MLS — around the country.

But agents can still agree to split commissions outside of those databases. They could simply do it by text or email. And a purchase offer or sales contract could spell out that a portion of the commission would go to the buyer’s agent.

“Most of the industry is going toward where the offer includes compensation terms,” said Theresa Hatton, chief executive of the Massachusetts Association of Realtors. “This could always be the case, but it may happen more often now.”

The CFA’s Brobeck believes the easiest way to live up to the spirit and letter of the settlement would be to roll whatever commission that buyers and their agents agree on into the mortgage. This would allow buyers to pay the cost over time instead of at closing, as they do now.

However, Fannie Mae, Freddie Mac, and the Federal Housing Administration, the government entities that buy or guarantee most mortgages, would have to amend their rules, which currently make rollovers difficult.

“I am optimistic that the current settlement creates so much confusion and conflict that within a year this financing will be possible,” said Brobeck, who believes that commissions will fall over time.

Other options: Buyers may ask sellers to pay some or all of their broker’s commission, as they sometimes do now with closing costs. Sellers might agree if the purchaser’s bid is a good one.

Or buyers may agree to pay their broker to represent them. If they do, Brobeck recommends a flat fee, because a commission based on the purchase price might encourage the broker to push more expensive homes.

Final thought: Upending the NAR’s commission model, which dates back to 1913, will be disruptive in the short term. In the long run, the settlement could fail to make much difference at all.

And that might not be so bad.

“People are losing out on opportunities simply because they are not prepared to make an offer on their own,” said Kim Powers, an agent with Coldwell Banker in Milton. “The focus on commissions is leaving buyers on the back burner.”