【中美创新时报2024 年 6 月 12 日编译讯】(记者温友平编译)消费者金融保护局周二表示,它正在计划制定一项规则,将医疗账单从信用报告中删除,并阻止贷方根据医疗信息做出决定。美联社记者汤姆·墨菲(TOM MURPHY)对此作了下述报道。

拜登政府正在努力防止在大多数关于某人是否有资格租房、买车或承担抵押贷款的决定中考虑医疗债务。

消费者金融保护局周二表示,它正在计划制定一项规则,将医疗账单从信用报告中删除,并阻止贷方根据医疗信息做出决定。

如果人们无法偿还贷款,拟议规则还将阻止贷方收回轮椅等医疗设备。

“任何人都不应该仅仅因为经历了医疗紧急情况而被剥夺获得经济机会的权利,”副总统卡马拉·哈里斯在制定计划规则的电话会议上表示。

政府于 9 月宣布了该规则的计划,一位高级政府官员表示,他们预计将于明年初完成该规则。

消费者局表示,医疗债务无法准确预测某人是否有可能偿还贷款。这些费用通常不像汽车或房屋购买那样是计划好的,患者可能无法控制严重疾病的进展。

局长罗希特·乔普拉周二还指出,研究表明,信用报告中经常出现账单错误。他说,这项规则将防止债务催收员“利用信用报告作为棍棒”强迫人们支付他们可能不欠的账单。

三大国家信用报告机构——益百利、Equifax 和 TransUnion——去年表示,他们正在从美国消费者信用报告中删除 500 美元以下的医疗催收债务。

但该局周二表示,即使做出这一改变,仍有 1500 万人的未付医疗账单出现在信用报告系统中。

“对于许多在就诊时为账单而苦恼的人来说,这将是一种巨大的解脱,”乔普拉周二在 ABC 的《早安美国》节目中说道,并透露了即将出台的规则。

专家警告说,医疗债务与许多健康和财务危害有关,例如精神健康状况恶化或获得额外医疗服务的延迟。

医疗债务“可能导致其他类型的财务脆弱性”,KFF 副总裁辛西娅·考克斯 (Cynthia Cox) 在给《华盛顿邮报》的短信中写道,KFF 是一家分析医疗债务的无党派医疗保健研究组织。“这是一个很难摆脱的循环,尤其是在他们生病和工作能力下降的时候。”

斯坦福大学经济学家尼尔·马奥尼 (Neale Mahoney) 表示,拟议的规则“可以产生有意义的影响”,他研究医疗债务,并于去年在白宫国家经济委员会任职。他指出,城市研究所最近的研究结果表明,医疗债务影响了至少 5% 美国人的信用评分。

但马奥尼引用自己的研究指出,许多背负医疗债务的人“信用报告上还有其他问题”,即使医疗债务得到解决,他们也很难获得贷款。

“一旦你的信用报告上已经有一堆贬义词(一个技术术语),删除一条甚至几条都不会对你的信用评分产生很大影响,”马奥尼说。

哈里斯在最近关于政府经济政策的演讲中谈到了制定新规则的必要性。

“医疗债务不能成为人们被拒绝汽车贷款、住房贷款或小企业贷款的原因,”哈里斯 5 月在底特律发表讲话时说。

“这只是道德上正确的事情,”几天后她在密尔沃基对人群说。

其他人正在努力解决医疗债务问题。佛蒙特州独立参议员伯尼·桑德斯和立法者上个月提出了一项法案,该法案将消除所有现有医疗债务,并实施限制措施以限制未来的医疗债务。

近年来,华盛顿特区、纽约和其他主要城市的民主党市长一直致力于减轻居民的医疗债务,他们以极低的价格购买现有债务并立即取消。

该提案将经过数周的公众评论——这意味着今年 11 月的选举可能会决定这些措施是否最终确定。共和党总统候选人唐纳德·特朗普在白宫任职四年期间,并没有寻求从消费者信用报告中删除医疗债务。

本报告使用了《华盛顿邮报》的材料。

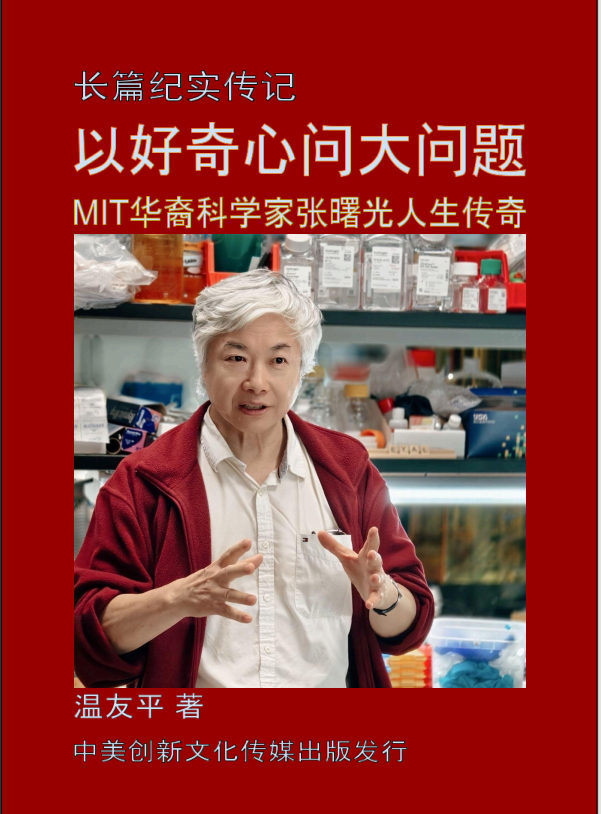

题图:消费者金融保护局周二表示,它正在计划制定一项规则,将医疗账单从信用报告中删除,并阻止贷方根据医疗信息做出决定。JACQUELYN MARTIN/美联社

附原英文报道:

Biden administration seeks to wipe consumer medical debt off most credit reports with proposed rule

By TOM MURPHY The Associated Press,Updated June 11, 2024

The Biden administration is pushing to prevent medical debt from being considered in most decisions made over whether someone qualifies to rent an apartment, buy a car, or take on a mortgage.

The Consumer Financial Protection Bureau said Tuesday it is planning a rule that would remove medical bills from credit reports and prevent lenders from making decisions based on medical information.

The proposed rule would also prevent lenders from repossessing medical devices such as wheelchairs if people cannot repay a loan.

“No one should be denied access to economic opportunity simply because they experienced a medical emergency,” Vice President Kamala Harris said during a conference call laying out the planned rule.

The administration announced plans for the rule in September, and a senior administration official said they expect to finalize it early next year.

The consumer bureau has said that medical debt can be a poor predictor of whether someone is likely to repay a loan. Those expenses often are not planned like a car or home purchase, and patients may have little control over the progress of a serious illness.

Bureau director Rohit Chopra also noted Tuesday that research shows billing errors frequently appear on credit reports. He said the rule would prevent debt collectors “from using the credit report as a cudgel” to force people to pay bills they may not owe.

The three national credit reporting agencies — Experian, Equifax, and TransUnion — said last year that they were removing medical collections debt under $500 from US consumer credit reports.

But the bureau said Tuesday that even with that change, 15 million people still have $49 billion in outstanding medical bills in collections appearing in the credit reporting system.

“This is going to be an enormous relief for so many people battling bills when it comes to medical visits,” Chopra said Tuesday on ABC’s “Good Morning America,” teasing the forthcoming rules.

Experts have warned that medical debt is linked to numerous health and financial harms, such as worse mental health or delays in obtaining additional medical care.

Medical debt “can lead to other kinds of financial vulnerability,” Cynthia Cox, vice president at KFF, a nonpartisan health care research organization that has analyzed medical debt, wrote in a text message to The Washington Post. “It’s a difficult cycle for people to pull themselves out of, especially at a time when they may be sick and less able to work.”

The proposed rules “can have a meaningful effect,” said Neale Mahoney, a Stanford University economist who has studied medical debt and served on the White House National Economic Council until last year. He pointed to recent findings by the Urban Institute that medical debt affects the credit scores of at least 5 percent of Americans.

But Mahoney, citing his own research, noted that many people who carry medical debt also “have other flags on their credit report” that can make it hard for them to get loans even when medical debt is addressed.

“Once you already have a bunch of derogatories — a technical term — on your credit report, having one removed, or even a handful removed, is not going to make a big difference in your credit score,” Mahoney said.

Harris has spoken about the need for the new rules in recent speeches focused on the administration’s economic policies.

“Medical debt cannot be the reason someone is denied a car loan, a home loan, or a small-business loan,” Harris said in remarks in Detroit in May.

“It’s just what’s morally right,” she told a crowd in Milwaukee days later.

Others are pursuing efforts to address medical debt. Senator Bernie Sanders, a Vermont independent, and lawmakers proposed legislation last month that would eliminate all existing medical debt and impose restrictions to limit future medical debt.

Democratic mayors in D.C., New York, and other major cities in recent years have worked to relieve residents’ medical debt by purchasing existing balances for pennies on the dollar and immediately canceling it.

The proposal will undergo weeks of public comment — meaning this November’s election will probably determine whether the measures are finalized. GOP presidential candidate Donald Trump did not seek to remove medical debt from consumers’ credit reports during his four years in the White House.

Material from The Washington Post was used in this report.