【中美创新时报2024 年 6 月 9 日编译讯】(记者温友平编译)前总统唐纳德·特朗普经常将杂货店和美国人购物的其他地方的价格上涨归咎于拜登总统,并承诺“解决这个问题”。但特朗普几乎没有解释他的计划将如何降低价格。根据对六位经济学家的采访,他的几项政策——无论它们在其他方面有何优点——反而会给价格带来新的上行压力。《纽约时报》记者Charlie Savage、Maggie Haberman 和 Jonathan Swan对此作了下述详细报道。

特朗普说,他计划进行“美国历史上最大规模的国内驱逐”,这很可能会增加劳动力成本。他打算对几乎所有进口商品征收新关税,这可能会提高它们的价格以及任何国产竞争对手的价格。

他不仅希望永久实施他和国会共和党人在 2017 年制定的整个赤字融资减税法,还希望为个人和企业增加某种新的“大减税”,以刺激已经充分就业的经济。

根据教科书上的经济学,特朗普的这三项标志性政策计划都可能提高价格。有些甚至可能导致持续而非一次性的价格上涨——增加了通货膨胀的可能性。

“我认为我们可以非常有信心地说,特朗普总统的贸易政策和移民政策将导致价格飙升,”右倾的美国企业研究所经济政策研究主任迈克尔·斯特兰说。

疫情后的通胀浪潮已经消退,但人们对它留下的高生活成本的不满正在拖累对经济和拜登表现的评估。

随着疫情消退,全球通胀飙升,而不仅仅是在美国。但许多经济学家认为,拜登政府 2021 年 3 月的刺激计划规模过大,虽然它可能促使经济增长比同类国家更快复苏,但也加剧了国内通胀问题。

在回答问题时,特朗普竞选团队的政策主管文斯·黑利 (Vince Haley) 对特朗普第二任期政策计划可能进一步推高价格甚至重新引发通胀的说法提出异议,称特朗普还将增加能源产量、削减监管并减少联邦支出。

黑利补充道:“可悲的事实是,乔·拜登没有降低通胀的计划;他计划继续他的通胀政策,浪费辛勤工作的美国人的钱包和钱袋,同时把责任归咎于士力架的大小。”

特朗普尚未公布详细的经济计划,因此无法模拟他可能采取的行动的总体影响。

但就特朗普在抨击通胀时提供的任何具体细节而言,他的主要宣传是谴责拜登政府旨在通过扩大可再生能源来遏制气候变化的政策。特朗普表示,他将提倡更多地开采化石燃料,以降低汽油和电力价格。

“我们将把你们的能源价格降到如此低的水平,这将彻底消除通货膨胀,”他在 12 月爱荷华州的一次集会上发表讲话时宣称。

特朗普还多次——错误地——声称美国已经“停止了石油勘探和生产”。虽然拜登确实扩大了对阿拉斯加荒野新钻探的限制,但他的政府颁发了数千张在其他联邦土地上钻探的新许可证——超过了特朗普的记录。美国的石油和天然气产量正创历史新高。

曾在乔治·W·布什总统任期内担任经济顾问委员会主席的哈佛大学教授格雷戈里·曼昆(N. Gregory Mankiw )表示,从国内开采更多石油将给能源价格带来一些下行压力。但他补充说,“由于石油是一个全球市场,这种影响将相当微弱。”

黑利表示,如果特朗普重返白宫,他将恢复并扩大第一任期的放松管制措施,并撤销拜登政府实施的新环境法规。他认为,这也将压低价格。

经济学家一致认为,无论政府法规给社会带来什么其他好处,遵守法规通常会增加企业的生产成本。

当过多的货币追逐过少的商品和服务时,通货膨胀(即货币购买力下降)就会加剧。物价几乎总是会小幅上涨,而通货紧缩与经济灾难有关。但在新冠疫情及其后果期间,物价上涨速度要快得多。

随着人们居家隔离,大量工人下岗,各国政府和央行试图通过财政和货币刺激措施来减轻破坏——包括直接增加支出和削减利率以鼓励借贷。然后,随着疫苗的问世,人们开始花掉他们通过不旅行和外出而省下的钱。就业市场迅速复苏。

经济活动的激增,加上供应链中断,导致商品短缺。在世界各地,可用商品的价格在 2021 年中期开始更快上涨,能源价格也是如此,在很少有人外出时,能源价格曾严重低迷。然后,在 2022 年初,俄罗斯入侵乌克兰,导致全球石油和食品价格进一步飙升。禽流感爆发导致鸡蛋短缺,鸡蛋价格飙升。

在美国,通货膨胀率在 2022 年 6 月达到峰值,为 9.1%——这是自 1980 年代初以来从未见过的水平。但美联储提高了利率,供应链问题得到解决,通货膨胀率下降。4 月份,价格比一年前高出 3.4%——仍然高于美联储理想的价格增长率,但更接近正常水平。

食品杂货的通货膨胀率下降尤其严重:2023 年 4 月至 2024 年 4 月期间,超市价格仅上涨了 1.1%。过去一年,工人的工资增长速度超过了物价上涨。

但通胀飙升留下了更高的价格——以及挥之不去的不满情绪。虽然通货膨胀困扰着世界各地的经济体,而且其许多促成因素不受美国政策制定者的控制,但领导人也做出了选择。

在特朗普执政期间,国会于 2020 年 3 月和 2020 年 12 月通过了紧急支出法案,在拜登执政期间,国会于 2021 年 3 月通过了紧急支出法案。在杰罗姆·鲍威尔(Jerome Powell)的领导下,美联储购买了债券,并将利率保持在低位以促进增长。鲍威尔先是被特朗普任命为美联储主席,后来又被拜登重新任命。

曼昆表示,许多经济学家现在认为,拜登在 2021 年 3 月提出的 1.9 万亿美元刺激法案对于已经开始复苏的经济来说规模过大,美联储将利率维持在低位的时间过长。

前美联储理事、如果特朗普赢得大选,可能被提名为美联储主席的凯文·沃什(Kevin Warsh)赞同曼昆对鲍威尔执政期间美联储的批评。他还认为,拜登和财政部长珍妮特·耶伦(Janet Yellen)对通胀浪潮负有共同责任,理由是政府的监管和“在充分就业的情况下大规模的新政府支出”。

但拜登执政期间的经济顾问委员会主席贾里德·伯恩斯坦(Jared Bernstein)为政府的表现辩护。他指出,数据显示,在疫情供应冲击期间,全球通胀率飙升,随后急剧下降,但美国的经济增长和就业复苏速度快于其他发达经济体。

“而部分原因,”他说,“恰恰与他们所批评的政策有关。”

尽管如此,许多美国人仍然对高物价感到焦虑,民意调查显示,许多可能在 11 月投票的人正在因物价上涨而惩罚拜登。

特朗普最具体的政策计划之一是大规模打击非法移民。近几届政府通常每年驱逐数十万非法移民,而特朗普的目标是将这一比例提高十倍。

驱逐数百万人将减少他们目前消费的商品和服务的需求,并可能降低出租房屋的价格,因为他们的驱逐将释放供应。但斯特兰说,大规模驱逐将对劳动力市场造成严重的供应冲击,这可能会增加整体生活成本。

那些低薪工作通常由非法居住在美国的移民从事,从采摘庄稼、从事建筑工作到在餐馆洗碗、打扫房屋和酒店房间,工人的短缺将日益加剧。在许多情况下,这些工人的工资低于最低工资,而且没有福利。

雇主会试图找到替代工人,但这并不容易。由于就业市场已经很强劲——失业率低于 4%——没有大量的美国人在寻找低薪工作。

基本经济学认为,产量下降和劳动力成本上升会导致价格上涨。例如,如果农民找不到足够的工人来收割所有的农作物,农产品供应就会减少,价格就会上涨。企业将被迫提供更高的工资来吸引或留住工人——将部分更高的成本转嫁给消费者。

事实上,特朗普的首席移民政策顾问斯蒂芬·米勒去年告诉《纽约时报》,“大规模驱逐将导致劳动力市场混乱,美国工人会为此欢呼雀跃,他们现在将获得更高的工资和更好的福利来填补这些工作。”

特朗普在担任总统期间对钢铁和洗衣机等某些产品征收了有针对性的关税,他计划在重返白宫后大幅扩大此类关税。他提出对大多数海外生产的产品征收 10% 的全面进口税——塔吉特和沃尔玛等商店货架上摆放的许多商品的来源,包括电子产品、机械、服装和玩具。

他计划对中国制造的产品征收特别高的关税,他在担任总统期间与中国展开了贸易战。两党都支持对华贸易设置一些壁垒;拜登保留了特朗普的关税,并对电动汽车和半导体等目标行业增加了一些关税。

特朗普通常否认进口税会提高价格。但哥伦比亚大学经济学家、曾担任乔治·W·布什经济顾问委员会主席的 R.格伦·哈伯德(R. Glenn Hubbard )表示,多项使用不同方法的研究证实,特朗普征收的关税“完全转嫁给了消费者”。

特朗普提出的第三项可能对通胀和价格产生影响的主要政策涉及税收。

特朗普 2017 年税法中的个人和遗产减税将在 2025 年后到期。虽然拜登希望延长对中低收入人群的减税,但他希望让这些减税对高收入水平和大额遗产到期。相比之下,特朗普希望全面延长该法律。他还含糊地表示,他希望采取某种额外的减税措施。

当特朗普和国会共和党人颁布 2017 年减税法案时,他们通过增加国家债务来弥补由此产生的收入缺口。如果他们重复这一举动,延长即将到期的减税措施将相当于财政刺激,尤其是富裕消费者的口袋里将有更多的支出资金。

曼昆说,更多的支出意味着对商品和服务的需求增加,与减税措施按计划到期的世界相比,价格将承受压力。

他还表示,如果美联储进一步提高利率,特朗普政策的潜在通胀方面可能会被抵消。

但这样的举动对特朗普来说是令人厌恶的,他作为房地产大亨喜欢低利率,在担任总统期间公开要求低利率,并承诺他的连任将恢复低利率。

本文最初发表在《纽约时报》上。

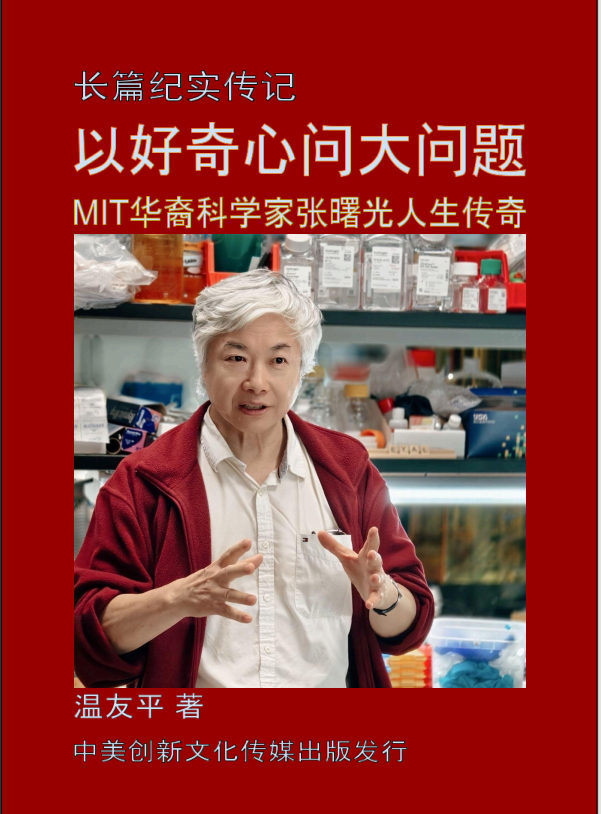

题图:今年,一名购物者在曼哈顿购买杂货。唐纳德·特朗普尚未发布详细的经济计划。但经济学家表示,他的三项关键提议将推高价格。HIROKO MASUIKE/NYT

附原英文报道:

Trump vows to lower prices. Some of his policies may raise them.

By Charlie Savage, Maggie Haberman and Jonathan Swan New York Times,Updated June 8, 2024

Former president Donald Trump routinely blames President Biden for higher prices at the grocery store and everywhere else Americans shop, and promises to “fix it.”

But Trump has offered little explanation about how his plans would lower prices. And several of his policies — whatever their merits on other grounds — would instead put new upward pressure on prices, according to interviews with half a dozen economists.

Trump says he plans the “largest domestic deportation in American history,” which would most likely increase the cost of labor. He intends to impose a new tariff on nearly all imported goods, which would probably raise their prices and those of any domestically made competitors.

And he not only wants to make permanent the entire deficit-financed tax cut law he and congressional Republicans enacted in 2017 but also wants to add some kind of new “big tax cut” for individuals and businesses, which would stimulate an economy already at full employment.

As a matter of textbook economics, each of those three signature Trump policy plans would be likely to raise prices. Some could even cause continued, rather than one-time, price increases — adding to the possibility of inflation.

“I think we can say with a lot of confidence that President Trump’s trade policies and immigration policies would result in price spikes,” said Michael Strain, the director of economic policy studies at the right-leaning American Enterprise Institute.

The post-pandemic inflation wave has subsided, but unhappiness over the elevated cost of living it left behind is dragging down assessments of the economy and of Biden’s performance.

Inflation surged globally as the pandemic receded, not just in the United States. But many economists believe the Biden administration’s March 2021 stimulus package was too big, and while it may have contributed to a faster recovery in growth than comparable countries have experienced, it also added fuel to the domestic version of the inflation problem.

In response to questions, the Trump campaign’s policy director, Vince Haley, disputed the notion that Trump’s second-term policy plans could raise prices further or even restoke inflation, saying that Trump would also increase energy production, cut regulations and reduce federal spending.

“The sad fact,” Haley added, “is that Joe Biden doesn’t have a plan to reduce inflation; he has a plan to continue his inflationary policies, laying waste to the wallets and pocketbooks of hardworking Americans all while blaming the size of Snickers bars.”

Trump has not released a detailed economic plan, so it is impossible to model the overall effects of what he might do.

But to the extent that Trump offers any specifics when railing about inflation, his primary pitch is to denounce Biden administration policies aimed at curbing climate change by expanding renewable energy. Trump says he would instead promote more fossil fuel extraction to make gasoline and electricity cheaper.

“We’re going to get your energy prices down so low, and that’s going to knock the hell out of the inflation,” he declared in remarks at a rally in Iowa in December.

Trump has also repeatedly — and falsely — claimed that the United States has “ended oil exploration and production.” While Biden did expand limits on new drilling in the Alaskan wilderness, his administration issued thousands of new permits to drill on other federal lands — outpacing Trump’s record. The United States is producing oil and natural gas at record highs.

Extracting even more oil from domestic soil would put some downward pressure on energy prices, said N. Gregory Mankiw, a Harvard University professor who served as chair of the Council of Economic Advisers during George W. Bush’s presidency. But, he added, “since it’s a global market for oil, that effect would be fairly muted.”

Haley said if Trump returned to office, he would revive and expand his first-term deregulatory efforts and roll back new environmental rules imposed by the Biden administration. That, he argued, would also push prices down.

Economists agree that whatever the other benefits to society government rules may bring, complying with regulations usually increases businesses’ production costs.

Inflation — a decrease in the purchasing power of money — increases when too much money is chasing too few goods and services. Prices are almost always rising a little, and deflation is associated with economic calamity. But during the COVID-19 pandemic and its aftermath, prices rose much faster.

With people hunkering down at home and huge numbers of workers laid off, governments and central banks tried to mitigate the devastation with both fiscal and monetary stimulus — including by directly spending more and by slashing interest rates to encourage borrowing. Then, as vaccines became available, people started spending the money they had saved by not traveling and going out. The job market rapidly recovered.

This surge in economic activity, along with supply chain disruptions, led to shortages of goods. Around the world, prices for available goods started to rise more quickly in mid-2021, as did energy prices that had been severely depressed when few were going out. Then, in early 2022, Russia invaded Ukraine, causing global oil and food prices to surge further. An outbreak of bird flu caused a shortage of eggs, the price of which soared.

In the United States, inflation peaked in June 2022, at 9.1% — a level not seen since the early 1980s. But the Federal Reserve lifted interest rates, supply chain problems were fixed, and the inflation rate fell. In April, prices were 3.4% higher than they were a year earlier — still higher than the Fed’s ideal rate of price growth, but closer to normal.

Inflation on groceries has dropped particularly steeply: Prices at the supermarket rose only 1.1% between April 2023 and April 2024. And wage growth for workers has outpaced price increases over the past year.

But the inflation surge left behind higher prices — and lingering discontent. And while inflation plagued economies around the world, and many of its contributing factors were outside the control of U.S. policymakers, leaders also made choices.

Congress passed emergency spending bills in March 2020 and December 2020 under Trump and in March 2021 under Biden. The Federal Reserve, under Jerome Powell — who was appointed its chair by Trump and then was reappointed by Biden — bought up bonds and kept interest rates low to boost growth.

Many economists now think Biden’s $1.9 trillion stimulus bill in March 2021 was too big for an economy that was already starting to recover, and that the Fed kept interest rates low for too long, Mankiw said.

Kevin Warsh, a former Fed governor and possible chair nominee if Trump wins the election, echoed Mankiw’s criticisms of the Fed under Powell. He also argued that Biden and Treasury Secretary Janet Yellen shared blame for the inflation wave, citing the administration’s regulations and “massive new government spending at full employment.”

But Jared Bernstein, the chair of the Council of Economic Advisers under Biden, defended the administration’s performance. He pointed to data showing that inflation spiked all around the world amid the pandemic supply shocks before sharply decelerating, but economic growth and jobs have recovered faster in the United States than in other advanced economies.

“And part of that,” he said, “has to do with precisely the policies that they are criticizing.”

Still, many Americans remain anxious about high prices, and polls indicate that many people likely to vote in November are penalizing Biden for higher prices.

One of Trump’s most concrete policy plans is a massive crackdown on illegal immigration. Where the government in recent administrations has generally deported a few hundred thousand unauthorized people per year, Trump is aiming for a tenfold increase in that rate.

The deportation of millions of people would reduce demand for the goods and services they currently consume and could bring down prices for rental housing as their removal frees up supply. But mass deportations would cause a severe supply shock to the labor market, which could increase the overall cost of living, Strain said.

There would be an accelerating shortage of workers for the low-wage jobs that are often performed by immigrants living in the country without legal permission — from picking crops and working construction jobs to washing dishes in restaurants and cleaning houses and hotel rooms. In many cases, such workers make less than minimum wage with no benefits.

Employers would try to find replacement workers, but it would not be easy. Because the job market is already strong — the unemployment rate is below 4% — there are not large numbers of Americans in search of low-wage jobs.

Basic economics say the result would be higher prices as production falls and labor costs go up. For example, if farmers could not find enough workers to pick all their crops, there would be a smaller supply of produce, and it would get more expensive. And businesses would be forced to offer higher wages to attract or retain workers — passing on some of their higher costs to consumers.

Indeed, Stephen Miller, Trump’s top immigration policy adviser, told The New York Times last year that “mass deportation will be a labor-market disruption celebrated by American workers, who will now be offered higher wages with better benefits to fill these jobs.”

Trump, who as president imposed targeted tariffs on certain products like steel and washing machines, is planning to greatly expand such duties if he returns to the White House. He has floated imposing a 10% across-the-board import tax for most products made abroad — the source of many of the goods lining the shelves of stores like Target and Walmart, including electronics, machinery, clothes and toys.

He plans to impose particularly high tariffs on products manufactured in China, with which he started a trade war when president. There is bipartisan support for erecting some barriers to trade with China; Biden kept Trump’s tariffs in place and added a few more on targeted industries, such as electric cars and semiconductors.

Trump typically denies that import taxes raise prices. But R. Glenn Hubbard, a Columbia University economist who also served as chair of the Council of Economic Advisers under George W. Bush, said multiple studies using different methodologies had confirmed that the tariffs Trump imposed were “completely passed on to consumers.”

A third major policy proposed by Trump that could have implications for inflation and prices involves taxes.

The individual and estate tax cuts from Trump’s 2017 tax law are set to expire after 2025. While Biden wants to extend the cuts for lower- and middle-income people, he wants to let them expire for higher levels of income and for large inheritances. By contrast, Trump wants to extend the law in its entirety. He has also vaguely indicated that he wants to go further with some kind of additional tax cut.

When Trump and congressional Republicans enacted the 2017 tax cut law, they made up the resulting gap in revenue by adding to the national debt. If they repeated that move, extending the expiring tax cuts would amount to fiscal stimulus, with more spending money in the pockets of especially wealthier consumers than would otherwise be the case.

More spending would mean higher demand for goods and services, straining prices when compared with a world in which the tax cuts expired as scheduled, Mankiw said.

He also said the potential inflationary aspects of Trump’s policies could be offset if the Federal Reserve were to further raise interest rates.

But such a move would be anathema to Trump, who loved low interest rates as a real estate mogul, openly demanded them as president and has promised that his reelection would restore them.

This article originally appeared in The New York Times.