【中美创新时报2024 年 4 月 2 日波士顿讯】(记者温友平编译)据三位直接了解该计划的消息人士透露,马萨诸塞州州长莫拉·希利 (Maura Healey) 计划冻结州政府部分部门的招聘,至少持续到 6 月份的财政年度结束,这是该州不稳定的财政状况尚未改善的另一个迹象。《波士顿环球报》记者Samantha J. Gross 和 Matt Stout对此作了下述报道。

冻结预计将于周三生效,就在政府计划发布最新收入预测的几个小时前,这可能表明税收收入继续落后于州官员用于公共服务预算的预测。

冻结的一些细节仍不清楚,包括希利政府预计此举可以节省多少钱。

在给《环球报》的一份声明中,希利的预算主管马修·戈兹科维奇证实了这一举措,但将其描述为“招聘控制”。他表示,希利政府正在采取这一行动“作为我们在未来三个月内负责任地管理支出的一种工具”。

戈兹科维奇说:“这些招聘控制虽然是暂时的,但将有助于确保政府能够在年底平衡预算,并为核心项目和服务保留关键资金。”

希利预算办公室的官员表示,某些职位,包括直接护理和公共安全领域的职位,将获得豁免。 季节性招聘、因法院命令或和解而必须填补的职位、休假返回以及 4 月 3 日之前收到录用通知书的新员工也是如此。

官员们表示,所有其他招聘都将得到希利预算办公室的批准,并补充说,政府“目前”不考虑进一步削减开支。

自去年以来,州税收收入一直在下滑,目前税收收入已连续八个月低于预测。即使希利政府在年初下调了该州的税收预测,截至 2 月份的税收收入仍比下调后的预测低 2.75 亿美元。

灯塔山的官员密切关注每月的收入数据,特别是在众议院和参议院准备在未来几个月内制定下一财年的预算计划之际。

一月份,希利公布了她自己的预算法案,这是一项 580 亿美元的计划,将比当前预算增加约 20 亿美元,即增加约 3.7%。这低于过去几年的增幅,希利将此作为证据,表明在大流行期间收入猛增一段时间后,官员们正在“勒紧裤腰带”。

然后在 1 月份,希利以税收收入低于预期为由,削减了 3.75 亿美元的支出,从为老年人提供外展服务、行为健康支持、无家可归者收容所和其他服务的项目中削减了数亿美元。

希利在当时写给立法者的一封信中表示,削减不会对学校经费或当地援助产生影响,州官员也没有计划解雇任何政府雇员。

与此同时,她的预算办公室还将本财年预计征收的税收金额下调了 10 亿美元。当时的收入为 7.69 亿美元,即落后该州本财年中期最初预测的 4% 左右。

经过多年有时破纪录的预算盈余后,税收收入从 2023 年开始减少。去年 4 月,该州税收在本财年结束前大幅下降,税收比预期少了约 6 亿美元。

官员们当时表示,其中绝大多数缺口(约 5.93 亿美元)涉及低于预期的资本利得税征收,而资本利得税是一个不稳定的收入来源。

与此同时,该州成本继续上升。例如,该州预计下一财年将花费 9.15 亿美元用于苦苦挣扎的紧急避难系统,该系统因无家可归和移民家庭的涌入而不堪重负。立法机关通过的一项支出法案将允许州长动用州托管账户中剩余的约 8.5 亿美元,该账户包含去年数十亿美元盈余的剩余资金。

这并不是政府第一次暂停招聘以解决预算漏洞。

2015年,时任州长查理·贝克(Charlie Baker)宣誓就职后仅24小时就实施了州冻结非必要工人的招聘。

当时,贝克在一份声明中表示,该州的赤字“证明马萨诸塞州面临着必须解决的支出问题”。

《环球报》工作人员艾玛·普拉托夫 (Emma Platoff) 对本报告做出了贡献。

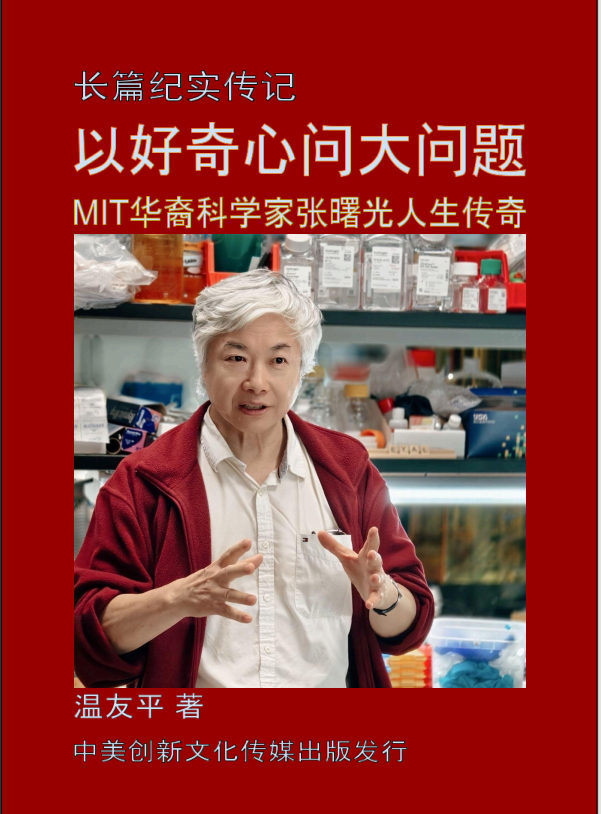

题图:2024年1 月份,州长莫拉·希利 (Maura Healey) 以税收收入低于预期为由,削减了 3.75 亿美元的支出。DANIELLE PARHIZKARAN/GLOBE STAFF

附原英文报道:

Amid dismal revenue forecast, Healey administration plans to freeze state hiring

By Samantha J. Gross and Matt Stout Globe Staff,Updated April 2, 2024

Governor Maura Healey plans to institute a freeze on hiring in portions of the state government lasting at least through the end of the fiscal year in June, according to three sources with direct knowledge of the plan, another sign the state’s rocky financial situation hasn’t improved.

The freeze, which is expected to take effect Wednesday, comes just hours before the administration is slated to release its latest revenue projections, and could indicate that tax collections continue to lag behind the projections state officials use to budget public services.

Some details of the freeze remained unclear, including how much money the Healey administration expects to save with the move.

In a statement to the Globe, Healey’s budget chief Matthew Gorzkowicz confirmed the move but characterized it as “hiring controls.” He said the Healey administration is taking the action “as one tool at our disposal to responsibly manage spending over the next three months.”

“These hiring controls, while temporary, will help ensure that the administration can balance the budget at the end of the year and preserve critical funding for core programs and services,” Gorzkowicz said.

Certain positions, including those in direct care and public safety, will be exempt, according to officials in Healey’s budget office. So are seasonal hires, positions that have to be filled due to a court order or settlement, returns from leave, and new hires who received offer letters before April 3.

All other hiring will be subject to approval by Healey’s budget office, officials said, adding that the administration is not considering additional spending cuts “at this time.”

State tax revenues have been sliding since last year, with collections now running below projections for eight straight months. Even after the Healey administration downgraded the state’s tax forecast at the start of the calendar year, revenue collections through February were still $275 million below even those lowered projections.

Officials on Beacon Hill closely monitor the monthly revenue figures, particularly as the House and Senate prepare to craft budget plans for the next fiscal year in the coming months.

In January, Healey unveiled her own budget bill, a $58 billion plan that would increase spending by about $2 billion over the current budget, or about 3.7 percent. That’s below increases of the past years, which Healey cited as evidence that officials are “tightening our belts” after a period of soaring revenues during the pandemic.

Then in January, Healey, citing lower-than-expected tax revenue collections, slashed $375 million in spending, cutting hundreds of millions from programs that provide outreach for seniors, behavioral health supports, homeless shelters, and other services.

In a letter to lawmakers at the time, Healey said the cuts won’t have an impact on school funding or local aid, nor are state officials planning to lay off any government employees.

At the same time, her budget office also lowered the amount of tax revenue it expected to collect this fiscal year by $1 billion. Revenues at the time were running $769 million, or about 4 percent, behind the state’s original projections midway through the current fiscal year.

After years of sometimes record-breaking budget surpluses, tax revenues began tailing off in 2023. The state’s take plummeted last April before it ended the fiscal year, having collected roughly $600 million less than it expected.

The vast majority of that shortfall, roughly $593 million, involved lower-than-expected collections of capital gains taxes, a volatile revenue source, officials said at the time.

At the same time, costs to state continue to mount. For example, the state projects it will spend $915 million in the next fiscal year for its struggling emergency shelter system, which has been overwhelmed by an influx of homeless and migrant families. And a spending bill moving through the Legislature would allow the governor to dip into the roughly $850 million left in a state escrow account that contains the remnants of last year’s multibillion-dollar surplus.

This would not be the first time an administration paused hiring to address a budget hole.

In 2015, then-governor Charlie Baker implemented a state hiring freeze for nonessential workers just over 24 hours after he was sworn in.

At the time, Baker said in a statement that the state’s deficit “proves that Massachusetts is facing a spending problem that must be remedied.”

Emma Platoff of the Globe staff contributed to this report.